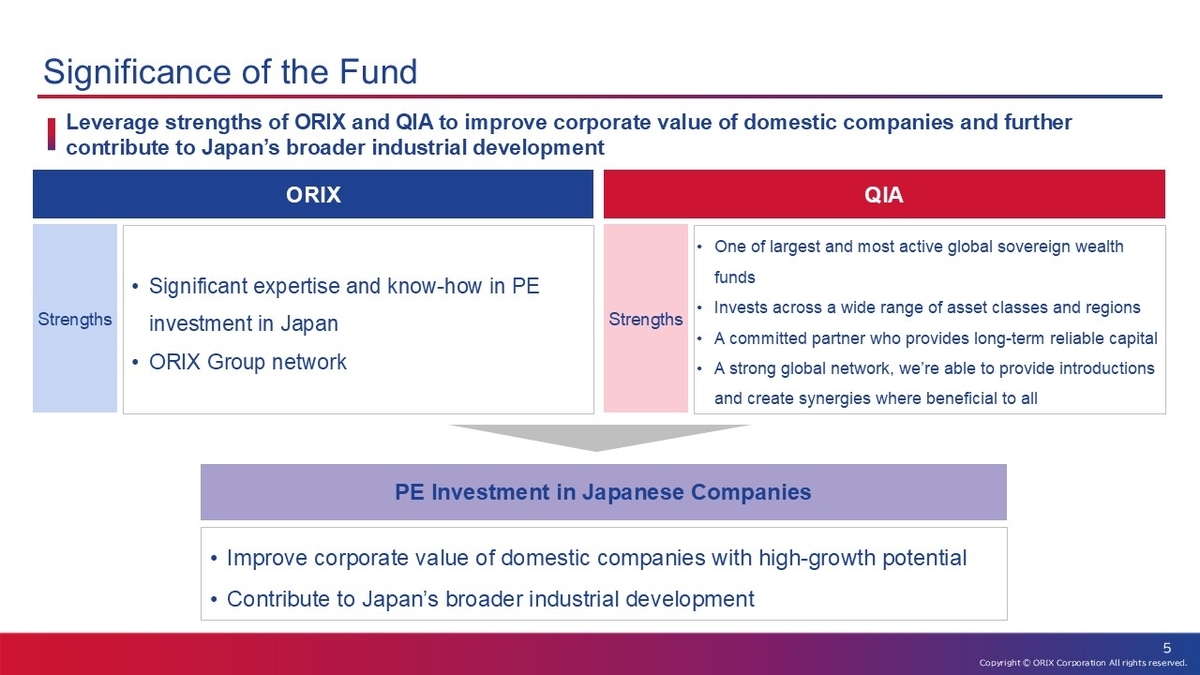

ORIX has long invested in, restructured and improved Japanese companies, not only for financial gain but also in an effort to contribute to Japan’s broader industrial development. Now it has found a heavy-hitting partner with the same long-term orientation in the Qatar Investment Authority (QIA), one of the world’s largest sovereign wealth funds. Together, the two aim to do meaningful private equity deals that will help to accelerate the growth of some of Japan’s most promising corporations.

They will do so through the launch of a new private equity platform with a commitment-based capital pool of $2.5 billion, the yen equivalent of which is expected to give the fund firepower of up to JPY1 trillion ($6.5 billion) once leverage is added. This makes it one of the largest PE funds ever launched in Japan by a domestic private entity, and it is the first time ORIX has welcomed a third-party investor into a domestic PE investment.

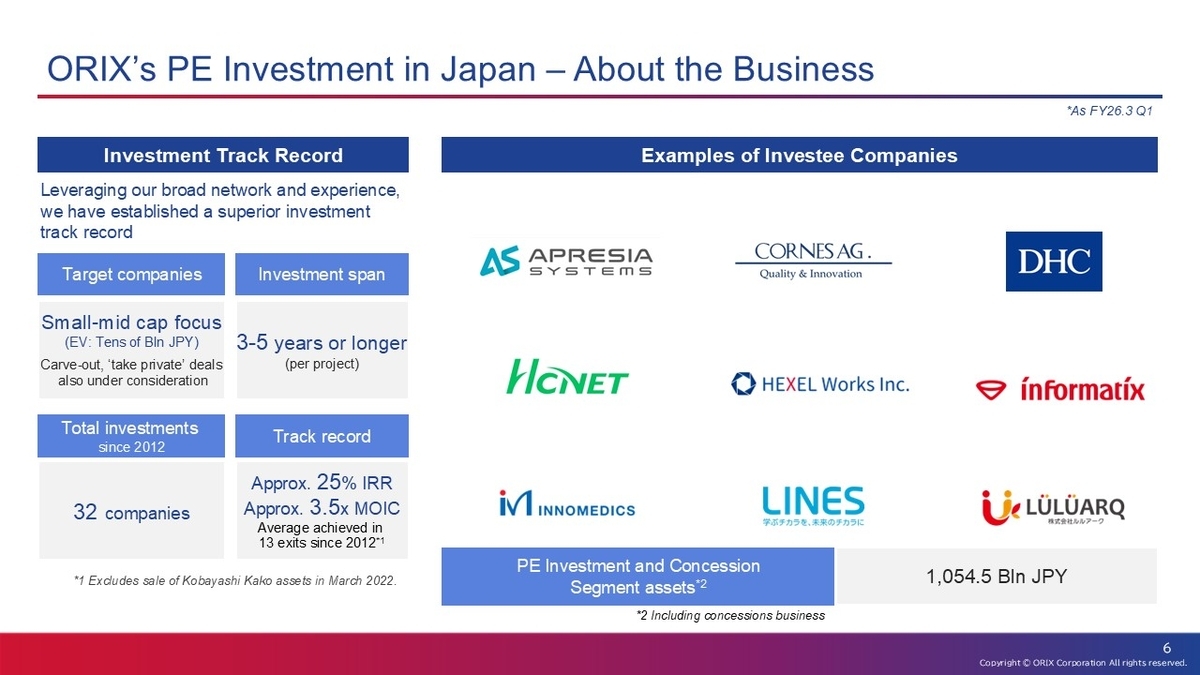

The fund will focus on Japanese companies with enterprise values of at least JPY30 billion (approx. $200 million), specifically targeting those with business succession issues – an ORIX specialty – the privatization of listed companies, and carve-outs of divisions from larger corporations. While there are no explicit sector targets, both partners point to healthcare, IT, and logistics, as well as a growing interest in biotechnology, robotics, and AI.

ORIX will contribute 60% and QIA 40% to the fund, with ORIX also sourcing opportunities from its domestic network as the fund GP’s service provider, as well as providing post-investment support. The fund’s term is set for 10 years, and the investment period will be 5 years, targeting medium to large size deals.

Following two years of discussions, Hidetake Takahashi, Chief Operating Officer of ORIX and Mohammed Saif Al-Sowaidi, Chief Executive Officer of QIA, both emphasize that the investment strategy and opportunity set are well-defined and the strong chemistry between the partners was in evidence at the press conference that unveiled the fund.

hold a press conference in Tokyo to announce the partnership

The Impact on ORIX

For ORIX, this is a pivotal step in accelerating the new growth strategy it launched in May 2025 and driving toward ambitious financial targets, including JPY100 trillion in assets under management (AUM) and an ROE of 11% or higher by March 2028.

By bringing in a third party, ORIX enhances its capital efficiency and expands the scale of deals it can pursue, moving beyond the limitations of its own balance sheet. “This partnership is a key strategic move to help realize our long-term growth strategy,” says Mr. Takahashi. “This partnership and fund are a big and meaningful step for us.”

One of the two key business models underpinning ORIX’s new growth strategy is that of ‘Alternative Investment & Operations’ under which the group aims to increasingly shift its operations to an asset manager model that is asset light and fee generating, while still maintaining operational control and the ability to improve the underlying assets. This new fund fits neatly into this new business model and will enhance ORIX’s capital efficiency as it seeks to match the performance of the world’s leading financial firms, including PE firms such as KKR and fund managers like BlackRock.

Indeed, the fund’s structure directly positions ORIX to become a serious domestic alternative to the big international PE firms, such as KKR and Bain Capital, that have traditionally dominated large-scale Japanese M&A. By leveraging its domestic expertise, extensive customer network and hands-on approach in managing investee companies, ORIX aims to become the go-to partner for complex transactions in Japan’s evolving corporate landscape.

ORIX’s PE activities have, until now, been funded exclusively with its own capital, meaning it has focused on small- to mid-cap targets. Over the past decade, it has completed more than 30 investments in Japanese companies, with a current portfolio of 18, primarily in healthcare and IT. Notable deals include an LP equity stake in Toshiba, and the purchase of DHC, a cosmetics and health food group.

A hallmark of ORIX’s approach is its hands-on management style, often seconding its own executives to portfolio companies to drive operational improvements. This strategy has delivered high IRRs, averaging 25%, and helped ORIX to win deals since sellers often prefer the stability and local understanding that ORIX brings. “We can help mid-sized companies facing succession issues due to Japan’s aging population,” notes Mr. Takahashi. “Our approach is not only about capital but also about partnership and support.”

A New Path for QIA

While QIA has invested in Japan for nearly two decades, in recent years it has increased its tactical allocation to the country, attracted by the improving economy, disciplined valuations and the positive impact of ongoing corporate governance reforms.

“Japan represents a core component of QIA’s long-term private equity strategy,” argues Mr. Al-Sowaidi, CEO of QIA. “With a deep pipeline of governance-driven deals and growing global investor interest, we see this as an exceptional opportunity to partner with best-in-class Japanese businesses to create value.”

Japan’s about 3.4 million small and medium-sized enterprises (SMEs) (as of 2021) form the backbone of Japan’s economy, playing a vital role not only in sustaining local communities but also in driving national innovation and competitiveness. Despite their relatively smaller scale, many of them are recognized globally for developing world-leading technologies and excelling in manufacturing, particularly in niche and high-value sectors such as electronic components, precision machinery, and semiconductor materials

For QIA, partnering with ORIX, provides access to an extensive domestic customer base of more than 400,000 SMEs that use the latter’s leasing, banking, insurance and financing services. Many of these are leaders in their fields but require capital to accelerate growth and unlock value – and often turn to ORIX for support given that Japan’s mega-banks tend to focus on large corporations.

to help enhance the corporate value of companies in Japan

But the fund is not just a financial partnership; it is a platform for broader cooperation. Both ORIX and QIA have indicated they will explore opportunities for collaboration beyond private equity, leveraging each other’s global networks and expertise. With QIA’s international reach and ORIX’s domestic footprint and operational know-how, the partnership is well-placed to support Japanese companies in going global.

The new partnership therefore marks a watershed moment for Japanese private equity, bringing together two heavyweight investors with complementary strengths and a shared vision for growth. As Japan’s corporate sector continues its transformation, the ORIX-QIA partnership is poised to play a pivotal role in shaping the next wave of value creation in the world’s fourth-largest economy.