For a lesson in how to navigate the rapidly evolving global Energy Transition while demonstrating strategic foresight and capital discipline ORIX’s journey with Greenko and AM Green is hard to top. What began as an investment in Indian wind power in 2016, and then turned into a bold bet on Indian renewables in 2021, has matured into a sophisticated, multi-phase investment in the next generation of ‘green molecules’ and clean technologies – with the Japanese corporate group displaying not only financial acumen but a deep commitment to decarbonization and long-term partnerships with fellow long-term investors such as Singapore’s sovereign wealth fund, GIC, and visionary entrepreneurs.

Founded in 2006 by Anil Chalamalasetty (CEO) and Mahesh Kolli (President), Greenko has grown from a small startup into one of India’s largest and most innovative renewable energy companies. As of March 2025, Greenko’s installed capacity stands at 7.3 Gigawatts (GW), spanning wind, solar, and -- most notably -- pumped storage hydroelectricity. The company’s rapid ascent has been fueled by its ability to deliver ultra-low-cost, long-duration renewable power, largely due to its pioneering work in large-scale pumped-storage facilities.

“Greenko’s differentiated approach, particularly in pumped hydro, enabled us to participate in one of the world’s most cost-competitive renewable energy platforms,” notes Mike Nikkel, Senior Managing Director, Global Business Development, Energy and Eco Services Business at ORIX. “The founders’ vision and execution have been exceptional, and their willingness to challenge conventional models set the stage for what came next.”

Global Business Development and Energy and Eco Services Headquarters at ORIX,

lead the relationships with Greenko and AM Green.

The Leap to Green Molecules

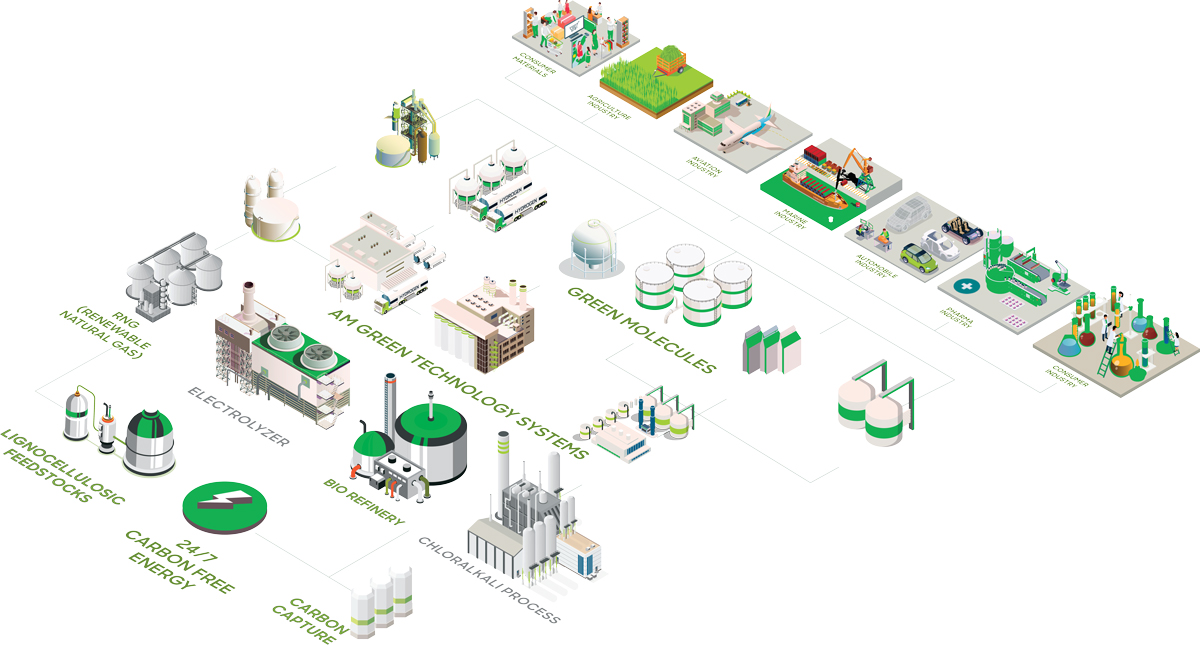

While renewable energy can reduce emissions from electricity production, decarbonizing heavy industry and transport also requires clean fuels and clean sources of heat and this is intensifying demand for green molecules such as hydrogen, ammonia, and sustainable aviation fuel (SAF). Recognizing this, Messrs. Chalamalasetty and Kolli launched AM Green in 2023, aiming to build a vertically integrated platform for these next-generation products. Their strategy: leverage Greenko’s cheap, reliable renewable power to drive large-scale electrolysis and downstream molecule production.

“AM Green’s approach is not just about building green hydrogen or ammonia plants,” explains Satofumi Suzuki, Senior Vice President, Global Business Development, Energy and Eco Services Headquarters at ORIX. “It’s about creating an end-to-end value chain -- from renewable electrons to green molecules to global offtake agreements. That’s what makes the platform scalable and globally relevant.”

To ensure robust cash flows during AM Green’s capital-intensive ramp-up, the founders orchestrated a financial restructuring: repurchasing a large stake in Greenko, making it an affiliate of AM Green, and embedding the former’s profit-generating assets at the heart of the new venture.

This structure allows AM Green to anchor its ambitious projects -- such as the 1 million tonnes per annum (MTPA) green ammonia facility in Kakinada, Andhra Pradesh (targeted for late 2026) -- on a foundation of operational excellence and cost leadership. It is also important to note that key projects, like Kakinada, are funded largely by debt and equity at the project level.

Capital Recycling, Continued Commitment

ORIX’s initial investment in Greenko in 2021 came when the Japanese group sold an 873MW domestic wind energy portfolio it had assembled since 2016 in return for a 20% stake. The 2021 deal was both timely and transformative, allowing ORIX to record a capital gain on the original 2016 investment. Over four years, ORIX not only supported Greenko’s expansion but also realized substantial value. Then in June 2025, ORIX agreed to sell its 20% stake in Greenko to AM Green for $1.3 billion, while temporarily retaining a 2.5% residual interest. Simultaneously, ORIX committed to a two-tranche $730 million investment in a convertible note issued by AM Green.

“This transaction is a textbook example of our capital recycling strategy,” says Mr. Nikkel – in fact, it was actually the second instance of capital recycling in this case, following the earlier 2021 sale of the original wind portfolio. “We realized a significant capital gain -- one of the largest in ORIX’s history -- while redeploying about half of the proceeds into a next-generation platform. It’s about backing winners repeatedly and amplifying impact, not just rotating capital for its own sake.”

Mr. Suzuki adds: “Our willingness to support Anil and Mahesh again reflects our belief in their track record and vision. We look for local partners who can scale globally, and these two have consistently delivered.”

India’s Competitive Edge

A recurring question in global energy circles is whether India can compete on cost in the emerging green molecule market. The answer, according to ORIX’s executives, is a resounding ‘yes’, thanks to India’s economies of scale as well as a pro-business government and regulatory environment that is very different from the era of the Licence Raj.

“Greenko, and by extension AM Green, is one of the lowest-cost producers of green ammonia in the world,” Mr. Nikkel observes. “The cost advantage comes from their ability to generate renewable energy at scale and store it efficiently, which underpins the economics of hydrogen and ammonia production.”

While political winds in the US have temporarily dampened enthusiasm for green hydrogen, cost-competitive demand from Europe, Japan, and other major economies remains robust. AM Green has already secured long-term offtake agreements with companies like Uniper and Yara Clean Ammonia, positioning itself as a key supplier to global markets.

And the vision extends beyond production. The company is building a full value chain: from manufacturing electrolyzers to producing a suite of green molecules, including methanol, SAF, and eventually green ethane, chlorine, and caustic soda. Strategic partnerships, with global energy majors, technology providers, and also financial investors, are central to this model. Notably, the Kakinada ammonia project is a joint effort with Petronas’s Gentari, Singapore’s GIC and others.

“AM Green is exceptionally good at partnering and dealmaking,” Mr. Suzuki emphasizes. “They’re not just product developers, they’re ecosystem builders. That’s critical for scaling up in a sector where offtake, logistics, and technology integration are all essential.”

Scaling Synergies, Delivering Purpose

ORIX is also thinking holistically: the reinvestment in AM Green is not an isolated bet, but a move designed to generate synergies across its broader environment and energy businesses. The company’s portfolio spans aviation, shipping, and renewables, including Elawan Energy in Spain, which boasts 4.7 GW of capacity worldwide.

“There’s a natural alignment between AM Green’s future production of SAF and our aviation leasing business, as well as the potential for green fuels in shipping,” Mr. Nikkel notes. “We’re already seeing collaboration opportunities, from facilitating offtake agreements to integrating supply chains. We are providing more than just capital.”

While investing in India and working with strong-willed entrepreneurs is not without its complexities, ORIX’s collaboration with Greenko and AM Green is emblematic of its broader purpose: “Finding Paths. Making Impact.” By recycling capital from a successful renewables investment into a new platform for green molecules, ORIX is not only generating strong returns but also advancing global decarbonization agenda.

“Ultimately, this is about being at the forefront of the energy transition,” Mr. Nikkel concludes. “We’re leveraging our global network, our experience in renewables, and our belief in the next generation of clean tech to create value -- for shareholders, for partners, and for society.”