Less than two hours by train or car from metropolitan Tokyo, nestled in the Hakone mountains, sits Hakone Gora KARAKU (KARAKU). This is an onsen resort, a classic Japanese inn, with all that this implies in terms of privacy, a traditional atmosphere and exceptional service.

But it is also modern, from the updated onsen – there are two open-air hot spring baths boasting water features and mountain scenery – to two restaurants serving exceptional modern Japanese cuisine and seasonal dishes. Meanwhile, all 70 guest rooms have a private onsen on their balcony, with spectacular views of the surrounding hills.

No wonder that four fifths of visitors, many of them from countries all around the world, give KARAKU a rating of ‘9+’ out of ‘10’ (“wonderful”) in the reviews they have written for one of the most popular online booking sites.

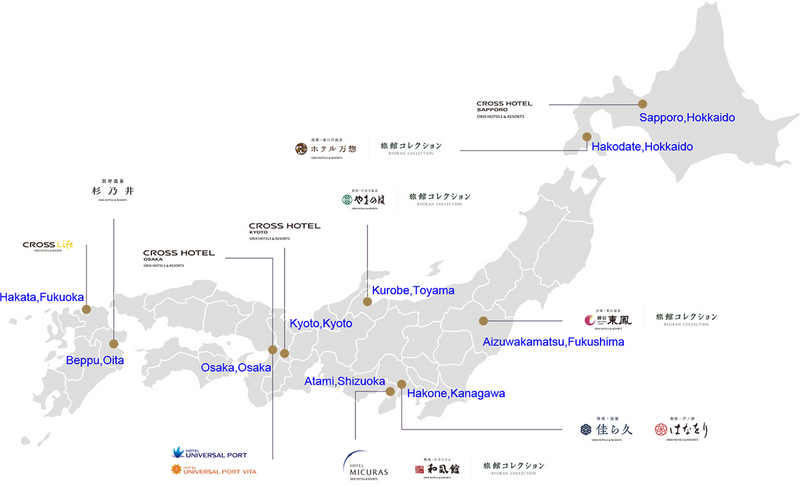

While KARAKU is one of the most luxurious, it is just one of 33 properties in the portfolio of ORIX Hotel Management Corporation (OHM), which currently comprises 27 accommodation facilities across Japan with approximately 5,800 rooms, as well as four training facilities, two aquariums and several other properties (as of July 2023). Some new facilities are also under development.

Some 15 of those are operated under the ORIX HOTELS & RESORTS brand, including not only the top-end onsen resorts but also the metropolitan CROSS HOTEL properties for business travelers and CROSS Life hotels for more casual tourists. Finally, OHM operates destination hotels, including two each near the Universal Studios Japan theme park and at Haneda airport.

The concept, reinforced by a brand update last year, is to cater to consumers whether they are on a romantic getaway, a family vacation or a business trip…with the hope that they will find a suitable ORIX hotel at every stage of their lives.

Booking back better

The entire estate was badly hit by the Covid-19 pandemic, with several properties closing down completely. The city center hotels suffered more than the rural resorts, which tend to be located in isolated spots and provide more private space for guests. Still, OHM as a whole fell into loss.

There has since then, however, been a good recovery, says Takaaki Nitanai, President of OHM and a Senior Managing Executive Officer at ORIX Real Estate Corporation: “Once the government started loosening travel restrictions in autumn 2022, our business gradually recovered.”

While that recovery has been led by domestic travelers and was initially centered on the onsen resorts, since the start of 2023 there has been a substantial influx in foreign tourists and, to a lesser extent, international business travelers that is also benefiting the metropolitan hotels. Currently, inbound visitors make up 70-80% of the guests at hotels in Tokyo, Osaka and Fukuoka – with relatively more Europeans and Americans and fewer Asians than before Covid.

Increasing numbers of international tourists are also staying at the onsen resorts like KARAKU and Hakone Ashinoko HANAORI in Hakone and now account for 40% of their bookings. Across the portfolio, occupancy rates are rising toward ORIX’s 80% target.

The return of inflation

Running hotels is no longer all about maximizing occupancy, though. Mr. Nitanai points out that there has been a fundamental shift in the market since the pandemic. Room rates, which had remained static for many years – and were cut sharply during the height of the Covid-19 crisis – are now rising rapidly. This is a global trend and one that is being reinforced by manpower shortages as many employees furloughed during the pandemic have opted not to return.

As a result, the Japanese hotel industry has switched to a strategy of offering better services and raising room prices, even at the risk of somewhat lower occupancy rates. Mostly, that trade-off is working. Leisure travelers, who are OHM's main customers, are "revenge spending" with the extra savings they accumulated during the lockdown, and will accept higher room prices if they are commensurate with the level of service. In city hotels, rates have tripled from the lowest rates of two years ago and while some businesspeople have switched to video conferencing, others are willing to pay up to hold essential face-to-face meetings.

This is welcome news for ORIX, which entered the hotel market in a small way the early 2000s --- after gaining experience in running training centers in city centers, as well as financing the revitalization of an onsen resort in Beppu.

Initially, ORIX management looked at hotels simply as another type of property asset that it could acquire, develop and sell on at a profit – as it does with office buildings, condominiums and logistics centers in its main Real Estate division.

But around 2018, ORIX took a strategic decision to re-start the business, and shift from a business model that revitalized hotels and sold them for capital gains in the short term to one that generates operating income over the long term. With this move, ORIX formally established OHM in 2020 and integrated all its facility management operations into this business unit, while investing in centralized operating and financial systems.

Growing the portfolio

“In short, we are Japan’s newest hotel chain,” says Mr. Nitanai, “And although we are just starting while others have been in this business for 100 years, we feel now is a good time for us to expand.”

One advantage ORIX has is that its portfolio is both flexible and diversified – with rural resorts balanced by city hotels as well as the destination venues. KARAKU is in the luxury category while the CROSS HOTEL properties and the other sub-brands are aimed at the mid-market and casual travelers.

A second strength is that the company has deep experience in selecting appropriate locations to open hotels based on a wealth of land information, and efficiently managing a wide-ranging real estate portfolio.

Even so, the expansion of its portfolio is being done steadily rather than all at once. OHM focuses on larger properties of 100-300 rooms and those are hard to find. Meanwhile, rising land prices are making it harder to buy or build new metropolitan hotels, especially in Tokyo and other big cities like Osaka, Sapporo and Fukuoka, where ORIX is still underweight.

There are three ways to accelerate growth. The first is to earn long-term profits by continuing to operate key facilities. The second is to win management contracts, where another hotel group owns and brands the property, which helps to increase the value of the OHM brand, and contributes to generating profits while controlling investment. Third, for certain locations where luxury hotels are a better option to maximize profits, operations are outsourced to operators such as Hilton and Hyatt. Although OHM does not own a luxury hotel brand, it has experience in managing facilities while working in partnership with external operators.

Looking forward

In time, the business could expand overseas if OHM can find the right foreign partner. While Japan has some excellent domestic hotel brands, such as Okura Nikko, it has no major international players. Mr. Nitanai muses that ‘omotenashi’ – the Japanese concept of providing not only impeccable service but making the guest feel truly at home – could provide the basis for a Japanese hotel operator to expand globally.

For now, however, there is lots to do at home, starting with improving returns from the existing properties, steadily enlarging the portfolio and strengthening the ORIX HOTELS & RESORTS brand. The business is also expanding the use of technology, from automated check-in and payment facilities to robot cleaners and waiters and driverless shuttle buses. And it is working to reduce both carbon emissions, in line with ORIX Group’s 2050 net zero target, and food waste through using smaller dishes, recycling and composting.

A growing challenge, meanwhile, is finding staff. Many young Japanese see hospitality jobs as low status with relatively poor pay and long hours. At the end of the pandemic, therefore, OHM started recruiting from Asia, visiting schools in Thailand, Vietnam, South Korea and Taiwan…and especially Indonesia. An international internship program is kicking off this autumn.

Considering Japan’s deteriorating demographics, Japan needs more travelers visiting the country. However, Mr. Nitanai is confident that tourists from abroad will more than fill any gaps left by domestic visitors and forecasts a bright future for the ORIX hotel business. After all, he says, Japan is an increasingly popular destination and who would not want to enjoy a truly authentic Japanese experience, such as that provided by a onsen resorts like KARAKU, as part of their trip.