Real Estate

Information as of March 31, 2024.

RE Investment and Facilities Operation

Business

Development and rental of office buildings, commercial facilities, logistics centers, and other properties; operation of businesses such as hotels, inns, and aquariums, in addition to asset management

| Assets | ¥689.6 billion |

|---|---|

| Profits | ¥43.3 billion |

Overview

Comprehensive Real Estate Business

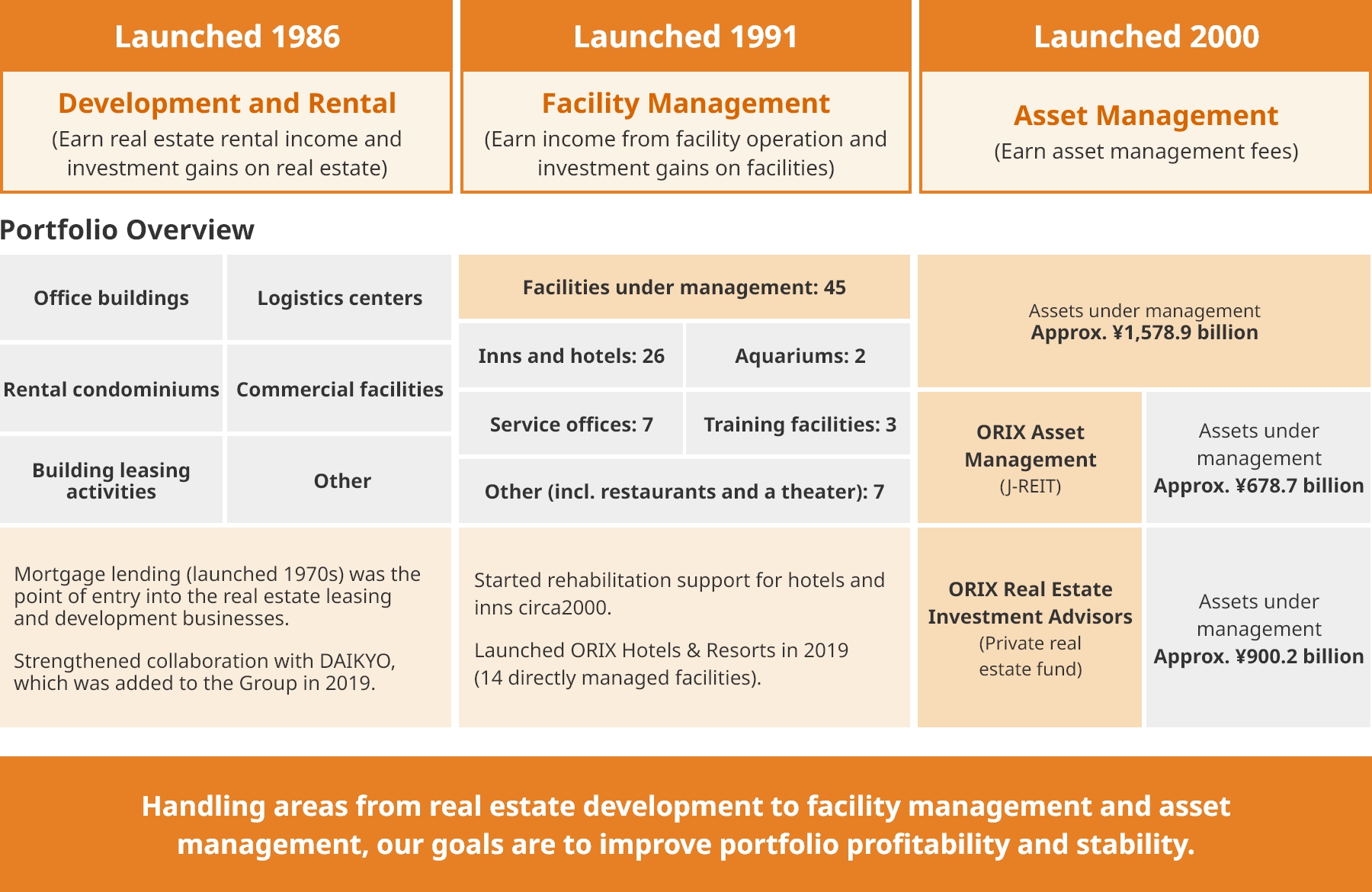

ORIX launched its real estate business in 1986 by leasing corporate dormitories for unmarried employees. We subsequently expanded into a diverse portfolio of businesses, including real estate development and rental, asset management, and facility operation. Our real estate business has comprehensive capabilities not found at other companies because we leverage ORIX Group’s network to collect information on properties, identify investors, attract tenants, and introduce customers to operating facilities.

Strengths

- Extensive expertise in the real estate business

- Information volume and proposal capabilities that fully leverage the Group’s network

Opportunities

- Recovery in domestic and overseas tourism demand following the end of the COVID-19 pandemic

- Firm domestic and overseas investor trends against a backdrop of relatively low interest rates and a weak yen

- Growing demand for properties with high environmental value

Risks

- Personnel shortages and rising operating costs at operating facilities

- Rising construction and equipment costs

- Market turmoil caused by sharp interest rate rises

RE Investment and Facilities Operation Business Portfolio

Leadership

- Leadership information updated as of June 25, 2025.

DAIKYO

Business

Development and brokerage of real estate and building maintenance and management, with a focus on condominiums

| Assets | ¥304.5 billion |

|---|---|

| Profits | ¥22.6 billion |

Overview

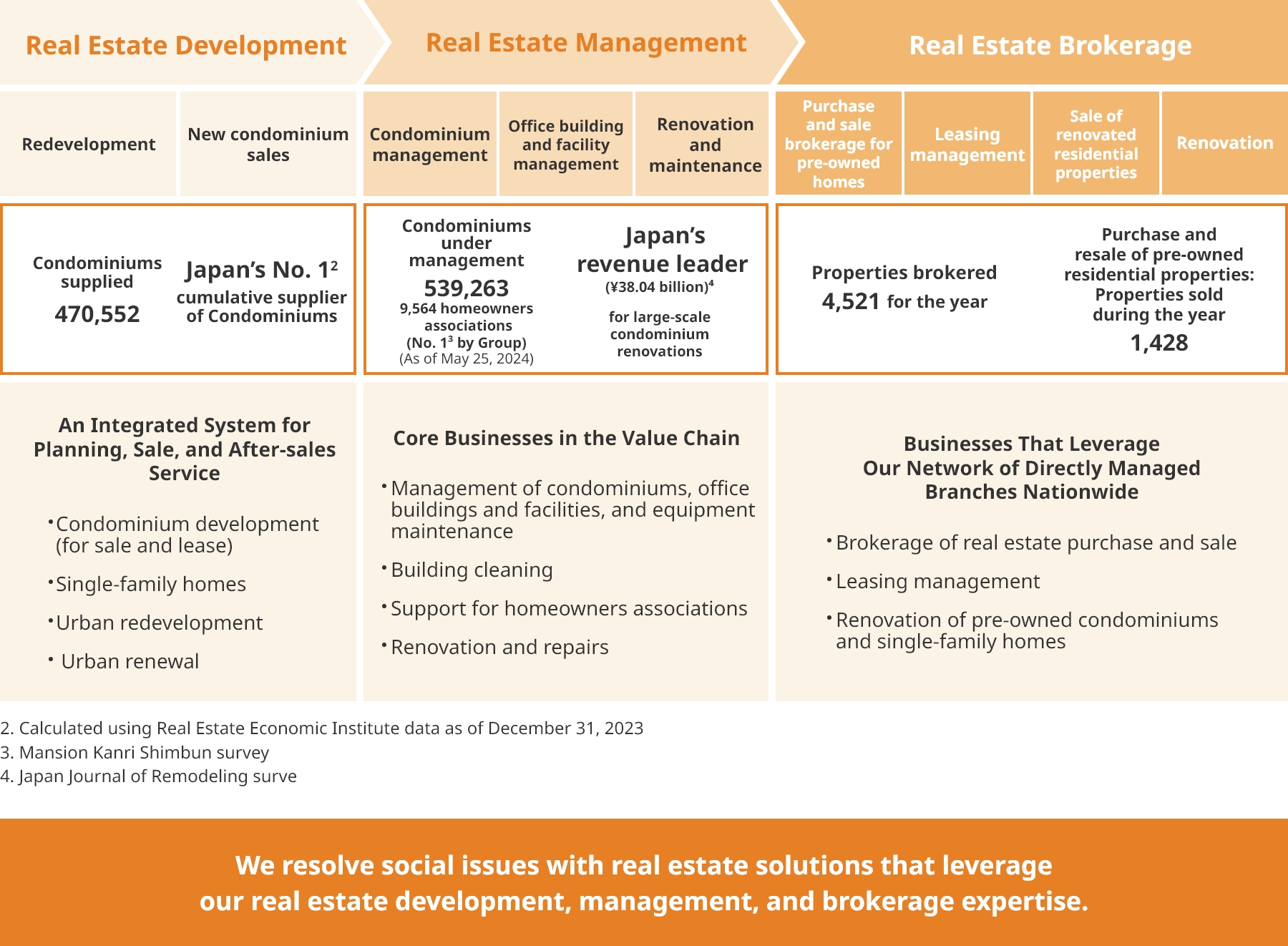

Japan’s Number One*1 Cumulative Supplier of Condominiums

ORIX took an equity stake in DAIKYO in 2005 and made it a wholly owned subsidiary in 2019. DAIKYO is involved in real estate development and brokerage and building maintenance and management, with a focus on condominiums.The real estate development business supplies new condominiums and rental condominiums. The real estate management business handles maintenance, cleaning, repair, and other services for facilities, and also provides support and other services for condominium homeowners associations. The real estate brokerage business brokers the purchase and sale of properties, purchases homes for renovation and resale by handling repairs and adding new value and functions, and provides management support for rental properties.

*1. Calculated using Real Estate Economic Institute data as of December 31, 2023

Strengths

- Development expertise and brand recognition of THE LIONS and SURPASS condominiums

- Stable revenues from building management, rental management, sales brokerage, repair work, remodeling, and other businesses originating from the condominium business

Opportunities

- Continuing strong demand in the new condominium market, despite rising sales prices

- Continuing growth in both prices and number of contracts concluded in the pre-owned market

Risks

- Rising land prices due to intensifying competition for site acquisitions

- Rising construction and equipment costs

DAIKYO’s Value Chain

Leadership

- Leadership information updated as of January 1, 2025.