Indonesia is the world’s most populous Islamic nation with over 230m people who adhere to the Muslim faith. That alone would seem to make it an ideal market for Islamic banking products that comply with Islam’s Sharia law (see box “Growing interest in no interest”).

But until a few years ago, this was mostly not the case. Neighboring Malaysia, which established Islamic banking in 1983, passed comprehensive legislation, set up Sharia banks and quickly put in place a regulatory framework. At the end of 2022, Islamic banking made up just over 40% of domestic bank loans while sukuk issuances accounted for two thirds of the Malaysian bond market, according to Fitch Ratings.

In Indonesia, by contrast, the first Islamic bank was founded in 1992 but it took another six years to write regulations and even then progress was incremental.

That changed in November of 2019, when Aceh, the nation’s westernmost province formally known as NAD, declared that all future financing activities inside its borders would have to be based on Sharia, a law which took effect in January, 2022. Aceh was where the spread of Islam through Indonesia and Southeast Asia began in the 13th century and while its population is relatively small at around 5.5m, 98% are Muslims (compared to 85% nationally) and it is rich in natural resources, including oil and gas.

Growing interest in no interest

Sharia-compliant finance, also known as Islamic finance, is banking or financing activity that complies with Sharia (Islamic law). Sharia prohibits riba or usury, generally defined as interest paid on loans or bonds, as well as investment in goods or services that are considered sinful and prohibited or haram, such as alcohol, pork or gambling.

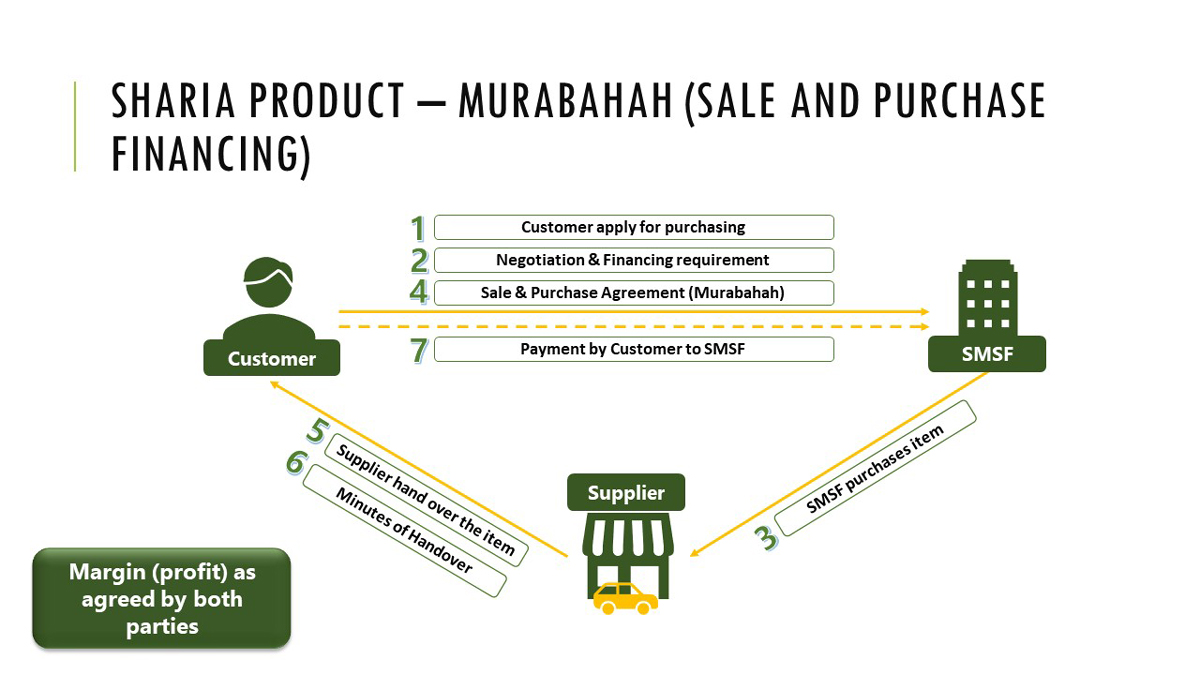

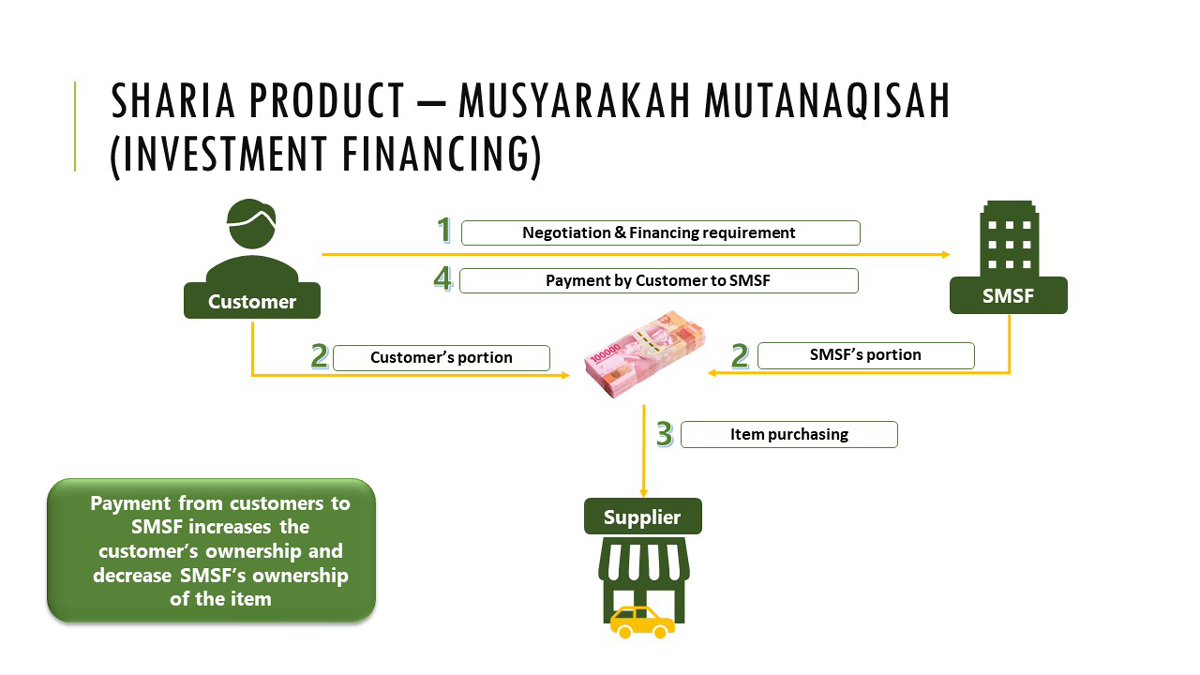

This has led to the evolution of alternative mechanisms to reward lenders for the risk they take, for instance by sharing the profits - though also the losses - of an investment (Mudarabah); by creating a joint venture (Musharaka); or by effectively rolling up the interest into the initial cost of the financing (Murabaha).

The market has grown rapidly since the first Islamic banks were established in the 1960s and the value of Islamic financial assets had reached almost $4 trillion worldwide by 2021, according to Statista. In terms of products, bank loans are still the largest category but Islamic bonds (Sukuk) have also become well-established and are traded in many financial centers. In recent years, insurance (Takafuls) and leasing (Ijara) products have also started to expand quickly.

The states of the Gulf Cooperation Council are the leading Islamic financial hub, with around 30% of the total assets. The rest of the Middle East, Pakistan, Bangladesh and Malaysia account for much of the rest, with Indonesia seen as a growth market with high potential. But Sharia finance is not confined to Muslim nations, with investors in other countries also increasingly attracted to its socially and ethically responsible approach.

Rapid growth from a standing start

This change in regulations led Sinar Mitra Sepadan Finance (SMS Finance), an established Indonesian retail finance company specializing in car loans owned by ORIX Group, to transform the product range of its branches in Aceh. Instead of a conventional car loans, customers are now offered two options, explains Hilman Syawal, Sharia Business Division Head at SMS Finance.

The first is a sale & purchase agreement (Murabahah) under which the cost of the vehicle includes a margin that effectively replaces the interest that would normally fall due over the life of the loan. The second, even more popular choice is investment financing (Musyarakah Mutanaqisah or MMQ). Under this arrangement, the customer not only uses the car but has a partial ownership of it from the beginning; and his ownership share increases with every payment made to SMS Finance, while the latter’s share falls.

The size of the Sharia leasing book is still small. Since its launch in September 2021, around 3,500 vehicles have been newly financed this way while a similar number of loans in Aceh have been converted to be Sharia compliant – for a total of just over 7,000 cars, trucks and pick-up vans. But growth has been rapid, with bookings more than doubling in the year to February to almost IDR30 billion ($2m). Islamic assets now stand at IDR265 billion ($18m), already over 7% of the total loan book.

Expanding both network and product range

This success is encouraging the company to move beyond Aceh and Sumatra. SMS Finance already has smaller points of sale in the capital Jakarta and the city of Banten on neighboring Java. Given that Indonesia comprises five main islands, 30 archipelagos and thousands of smaller islets, there is room for many years of geographical expansion.

At the same time, Mr Syawal says he is studying new products. One idea is to offer financing for education given that the market for private schools is growing and more and more Indonesians are aiming for higher education.

A second thought is to offer funding for Haj pilgrimages. Every Muslim is supposed to visit Mecca at least once, but the expense can be prohibitive, even though Saudi Arabia cut its fees last year. A typical pilgrimage costs around IDR90m ($6,000), almost a year’s average salary. Even though the Indonesian government subsidizes around two fifths of that, many travelers will not be able to pay for the trip upfront.

More generally, Mr Syawal points to an overlap between Islamic finance and the ESG-based financing trend that is sweeping the world. Both are based on ethical and sustainable principles, so it may be possible in future to structure, say, project financing for renewables like solar and wind farms, to be Sharia-compliant.

While the potential for growth is clear, the main challenge, according to Mr Syawal, is improving financial literacy in general and knowledge of Sharia products specifically. Research suggests that most Indonesians would open an Islamic bank account or take out a loan or lease if they knew about such services and had them clearly explained.

Government regulation can be a key driver of this, as the example of Aceh shows. In the meantime, SMS Finance is planning to widen its reach through partnerships with, among others, insurers and auction houses – though this relates primarily to its core vehicle loan business.

Spreading the word

This is even truer of Malaysia. Taking advantage of the country’s established legal and regulatory framework for Islamic finance, ORIX Leasing Malaysia (OLM) Group has offered Sharia-compliant leasing, hire purchase, rental and factoring contracts since 2017.

The concept is somewhat different with OLM Group’s products based on the Ijarah principle, which is essentially a leasing/rental approach, while SMS Finance uses the Murabaha principle which focuses on credit sales by instalment. The main difference is that in the former, the ownership of the asset always remains with the financier, while in the latter it transfers to the customer on completion of the contract.

It is certainly working. In the 2023 fiscal year, these four products – which have been certified by the Islamic Banking and Finance Institute of Malaysia - contributed about a quarter of OLM Group’s total business volume. “Being the pioneer in offering Islamic rental has given us a competitive edge and we are confident our Islamic products will contribute significantly to our growth in coming years and will help us maintain our market leadership in Malaysia”, says Eric Wong Heng Yip, Advisor to the Shariah Committee at OLM Group.

In Pakistan, meanwhile, ORIX sells both Islamic leases and asset management products that are similar to investment trusts and it would be no surprise to see launches in other promising markets. This is in line with ORIX Group’s continuing focus on answering the local needs of its customers around the world – and the demand for Islamic finance products is only going to keep rising.