Addressing Climate Change

Addressing Climate Change

Confronting climate change is a key theme that must be addressed on a global scale. Ongoing global warming in the absence of effective countermeasures will cause drastic climate change that will significantly impact the global environment. Against this backdrop, carbon neutral initiatives to reduce greenhouse gas (GHG) emissions to virtually zero have swiftly been gaining traction worldwide.

ORIX has made addressing climate change one of its material issues , and has stated its intent to proactively promote the renewable energy business, reduce GHG emissions in its own businesses, and comply with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). We have also set the key goals of reducing ORIX Group GHG (CO2) emissions by 50% compared to the fiscal year ended March 2020 by the end of the fiscal year ending March 2030, and achieving net zero emissions by the end of the fiscal year ending March 2050*.

ORIX will continue to proactively respond to the risks and opportunities brought about by climate change through its diverse businesses. We will also utilize the TCFD information disclosure framework to strengthen climate change-related governance and risk management through scenario analysis. Based on such measures, we will disclose more specific information on ORIX’s climate change initiatives to our stakeholders.

Please refer to Material Issues and Key Sustainability Goals for our material issues and key sustainability goals.

Please refer to the following links for climate change-related initiatives:

- Environment and Energy Business

- CO2 Avoided Emissions through the Renewable Energy Business / ORIX Group's GHG Emissions

* All key sustainability goals are subject to compliance with local law. For example, where diversity goals may be unlawful, the targets do not apply.

Information Disclosure Based on TCFD Recommendations

ORIX announced its support for the TCFD in October 2020. In November 2021, we began disclosing information in line with the TCFD information disclosure framework (Governance, Strategy, Risk Management, and Metrics and Goals).

Governance

【Board Oversight of Climate-related Risks and Opportunities】

The Board of Directors provides leadership and guidance for ORIX Group’s sustainability. It oversees climate-related risks and opportunities and determines ESG-related material issues and key goals.

In fiscal year ended March 2025, at the Board of Directors meeting the status of regulatory compliance regarding the disclosure of non-financial information was reported.

【Execution Framework for Assessing and Managing Climate-related Risks and Opportunities】

The Group CEO chairs the Sustainability Committee. Committee members include people in charge of segments most directly related to ESG, and other participants will attend as needed so the committee can flexibly accommodate an evolving agenda. The committee will also call on external experts as necessary.

The Sustainability Committee discusses specific measures to achieve goals as well as conflicts arising between short-term earnings and long-term growth. It also holds discussions on measures to reduce climate change risk based on TCFD recommendations, share information on developments in Japan and internationally that are relevant to sustainability, and discuss matters to report to the Board of Directors.

Please see here for details on Sustainability Governance Structure and Sustainability Promotion Status.

Strategy

【Climate-related Risks and Opportunities the Organization Has Identified】

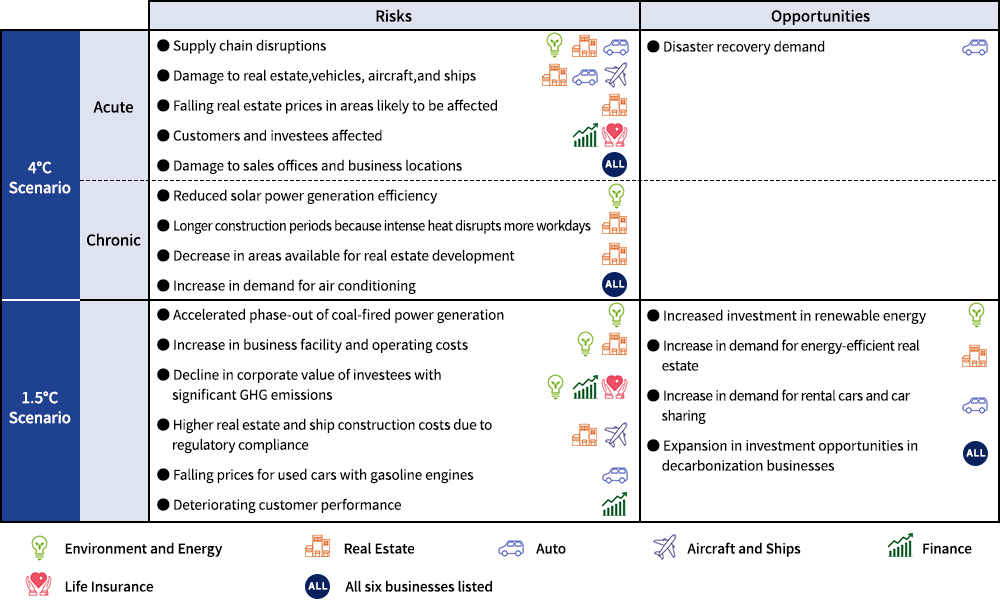

Climate-related risks and opportunities include physical risks and opportunities brought about by the increase in natural disasters associated with climate change. They also include transition risks and opportunities associated with the transition to a decarbonized society resulting from more stringent climate-related regulations and changes in corporate and consumer preferences. We expect the following will materially impact ORIX Group:

●Physical Risks and Opportunities

ORIX is exposed to physical risks including higher costs due to business suspension and preventive measures or repairs for damage to operating facilities and offices, higher operating and construction expenses resulting from higher temperatures, higher credit costs from damage to customers, and loss of asset value from damage to investees.

●Transition Risks and Opportunities

ORIX is exposed to transition risks including business suspension, loss of asset value, stranded assets due to more stringent regulations, higher costs associated with carbon emissions, higher credit costs due to deterioration in customer performance, and decreased corporate value of high GHG-emission investees. Associated opportunities include increasing demand for renewable energy.

【Scenario Analysis】

●Assumptions

4°C Scenario

The average global temperature at the end of the 21st century is about 4°C higher than preindustrial levels. Government policies of each country in addition to corporate and consumer preferences remain the same. For example, coal use continues, renewable power generation gains limited traction, no full-scale introduction of carbon pricing, demand for energy-saving real estate remains limited, electric vehicles do not become widespread, and the shift away from ownership-based vehicle usage stalls. The physical effects of climate change become apparent and can be felt directly.

Reference scenarios: Transitional: Stated Policies Scenario (STEPS)*1 (IEA WEO 2024), Physical: SSP*2 5-8.5 (IPCC AR6)

1.5°C Scenario

The average global temperature increase at the end of this century can be kept at 1.5°C compared to preindustrial levels. Aggressive government decarbonization policies move forward, corporate and consumer tastes change, and society shifts. There will be no significant change from the current physical impact of climate change.

Reference scenarios: Transitional: Net Zero Emissions by 2050 (NZE)*1 (IEA WEO 2024), Physical: SSP*2 1-1.9 (IPCC AR6)

- A scenario presented in World Energy Outlook 2024, published by the International Energy Agency (IEA) in 2024.

- Shared Socioeconomic Pathways: Models for estimating temperature increase presented in the Intergovernmental Panel on Climate Change Sixth Assessment Report (IPCC AR6). Each SSP is numbered in ascending order, with higher numbers associated with greater estimated temperature increases.

●Degree of Impact Assessment

In the Environment and Energy business and Real Estate business, we own and operate large facilities including large power plants and hotels and inns, and their GHG emissions have become significant. Our scenario analyses have identified risks corresponding to both the 4°C and 1.5°C scenarios, along with significant opportunities in the 1.5°C scenario.

The Auto business and Aircraft and Ships business involve significant GHG emissions from customer use of leased assets, but our scenario analyses identified only limited risk in either scenario.

The Finance business and Life Insurance business involve significant GHG emissions from investees and borrowers, but we concluded that the impact of potential risks and opportunities is not material.

Please see here![]() [190KB] for the scenario analysis results for each business division.

[190KB] for the scenario analysis results for each business division.

Risk Management

When formulating business plans, we collate progress on ESG-related key goals and the policies and KPIs of each business division, report them to the Sustainability Committee, and obtain approval from the Board of Directors. In addition, once every year each business unit holds discussions with the Investor Relations and Sustainability Department and updates the scenario analysis assumptions and results.

Metrics and Goals

【Metrics and Goals Used to Assess and Manage Relevant Climate-related Risks and Opportunities】

ORIX identified the following four key goals related to climate:

- Reduce ORIX Group GHG (CO2) emissions by 50% by the fiscal year ending March 2030 compared to the fiscal year ended March 2020.

- Reduce ORIX Group GHG (CO2) emissions to net zero by the fiscal year ending March 2050.

- Reduce investment in and lending to industries* that emit GHG (CO2) by 50% by the fiscal year ending March 2030 compared to the fiscal year ended March 2020.

- Reduce investment in and lending to industries* that emit GHG (CO2) to zero by the fiscal year ending March 2040.

- Refers to fossil fuel mining, palm oil plantations, and forestry financed by ORIX Group overseas subsidiaries.

Please see here for details on GHG (CO2) Emissions Reductions.

Please see here for details on Key Goals.

【Scope 1, 2, and 3 GHG Emissions】

Please see here for details on Scope 1, 2, and 3 GHG Emissions.

ORIX Group companies Robeco and ORIX Asset Management also disclose information as per TCFD recommendations.

Please refer to their respective reports for further details. (Robeco![]() / ORIX Asset Management

/ ORIX Asset Management![]() )

)

GHG Emissions Reduction Goals

One of ORIX’s key sustainability goals is to reduce GHG (CO2) emissions by 50% by the fiscal year ending March 31, 2030 compared to the fiscal year ended March 31, 2020. We also intend to reduce GHG (CO2) emissions to net zero by the fiscal year ending March 2050*1.

ORIX’s GHG baseline emissions were 1,266 thousand tons CO2e in the fiscal year ended March 31, 2020. The breakdown by business is as follows.

| Share of emissions | Emissions | (Scope1) | (Scope2) | ||

|---|---|---|---|---|---|

| Environment and Energy | Overall | 86.0% | 1,089 | 1,069 | 20 |

| Agatsuma Biomass Power Plant (percent of total) | 2.8% | 35 | 35 | 0 | |

| Soma Coal and Biomass Power Plant (percent of total) | 35.7% | 452 | 451 | 1 | |

| Hibikinada Coal and Biomass Power Plant (percent of total) | 38.6% | 489 | 488 | 0 | |

| ORIX Environmental Resources Management’s Yorii waste incineration facility (percent of total) | 7.3% | 93 | 85 | 8 | |

| Real Estate | Overall | 6.7% | 85 | 19 | 66 |

| Facilities Operations Business (percent of total) | 4.7% | 60 | 16 | 44 | |

| Corporate Financial Services and Maintenance Leasing | 0.9% | 12 | 1 | 11 | |

| PE Investment | 4.1% | 52 | 14 | 38 | |

| Insurance, Banking, and Credit | 0.7% | 9 | 0 | 9 | |

| Outside Japan | 0.8% | 10 | 2 | 8 | |

| Other management departments, etc. | 0.8% | 10 | 1 | 8 | |

| Total | 100.0% | 1,266 | 1,107 | 158 | |

- All key sustainability goals are subject to compliance with local law. For example, where diversity goals may be unlawful, the targets do not apply.

- From the calculation of ORIX Group GHG emissions for the fiscal year ended March 31, 2021. The calculation includes emissions from overseas subsidiaries and investees. We also reviewed the method for calculating GHG emissions from treatment of waste plastics at our waste incineration facility in Yorii Town, Saitama Prefecture. The resulting figures represent ORIX Group GHG baseline emissions for the fiscal year ended March 31, 2020.

Total Scope 1 and Scope 2 emissions in the fiscal year ended March 2025 were 1,064 thousand tons. Compared to the baseline emissions, this was a decrease of 202 thousand tons. Emissions from the two coal-biomass co-fired power plants amounted to 810 thousand tons, accounting for 76.1% of the total.

As a measure to reduce GHG emissions at the two coal and biomass power plants with high emissions, we are considering measures such as equipment modifications to shift to biomass-only combustion in line with the ORIX Group’s GHG (CO2) emissions reduction targets. In the fiscal year ended March 2025, we carried out the following initiatives related to the transition to pure biomass combustion:

1) Consideration of demonstration testing to increase the co-firing ratio

2) Negotiations concerning fuel procurement, storage, and transportation following conversion to pure biomass combustion

3) Specific negotiations with multiple electricity users regarding the sale of renewable energy electricity after the conversion

Regarding Scope 3 (GHG emissions in the value chain), we have roughly estimated the scale of emissions from the Auto, Real Estate, and the power generation and electric power retail business in the Environment and Energy segment, Aircraft and Ships, as well as emissions from investees and borrowers (Category 15). We disclose numerical data for Categories 6 and 7.

- Please refer to ORIX Group’s GHG emissions here.

Promoting the Renewable Energy Business

ORIX operates power generation businesses around the world as a global renewable energy company. As of March 31, 2025, our generation capacity of power plants in operation around the world, including Japan, was 4.7 GW*1 .

Going forward, ORIX plans to expand capacity while also considering the use of third-party capital. The total capacity of assets under ownership and management is projected to reach 5.6 GW*2 in 2028 and 25 GW*2 in 2035.

Also, in Japan, we are promoting broader adoption of renewable energy through our business of operation, management, and maintenance of power plants that use renewable energy, the energy storage plant business, and the introduction of a third-party ownership model for solar power generation systems.

- Does not include capacity prior to start to operations, such as during the construction phase. Capacity figures adjusted to reflect ORIX’s ownership stake.

- Does not include capacity prior to start to operations, such as during the construction phase. Capacity figures of “Owned” is adjusted to reflect ORIX’s ownership stake.

| Types of Renewable Energy Sources | Capacity (GW) |

|---|---|

| Solar | 2.3 |

| Onshore Wind | 1.4 |

| Hydro | 0.6 |

| Other | 0.4 |

| Total | 4.7 |

CO2 Avoided Emissions through the Renewable Energy Business

CO2 avoided emissions at our renewable energy businesses totaled approximately 4.883 million tons for the fiscal year ended March 2025. The year-over-year increase was approximately 0.122 million tons. This was mainly due to the start of operations of new renewable energy power plants in Spain and increased operations at a hydroelectric power plant in India.

Breakdown by country, region, and generation type is as shown in the chart below.

| Wind Power | Solar Power | Geothermal Power | Hydro Power | Biomass | Total | |

|---|---|---|---|---|---|---|

| India | 1,111 | 582 | - | 371 | - | 2,064 |

| Spain | 203 | 578 | - | 39 | - | 821 |

| U.S.A. | 322 | 116 | 283 | - | 23 | 745 |

| Japan | - | 434 | 8 | - | 243 | 684 |

| Others | 563 | 1 | - | 5 | - | 569 |

| Total | 2,200 | 1,710 | 291 | 416 | 266 | 4,883 |

- Please refer to CO2 Avoided Emissions through the Renewable Energy Business here.