PE Investment and Concession

Information as of March 31, 2024.

PE Investment

Business

Private equity investment

| Assets | ¥738.4 billion |

|---|---|

| Profits | ¥37.9 billion |

Overview

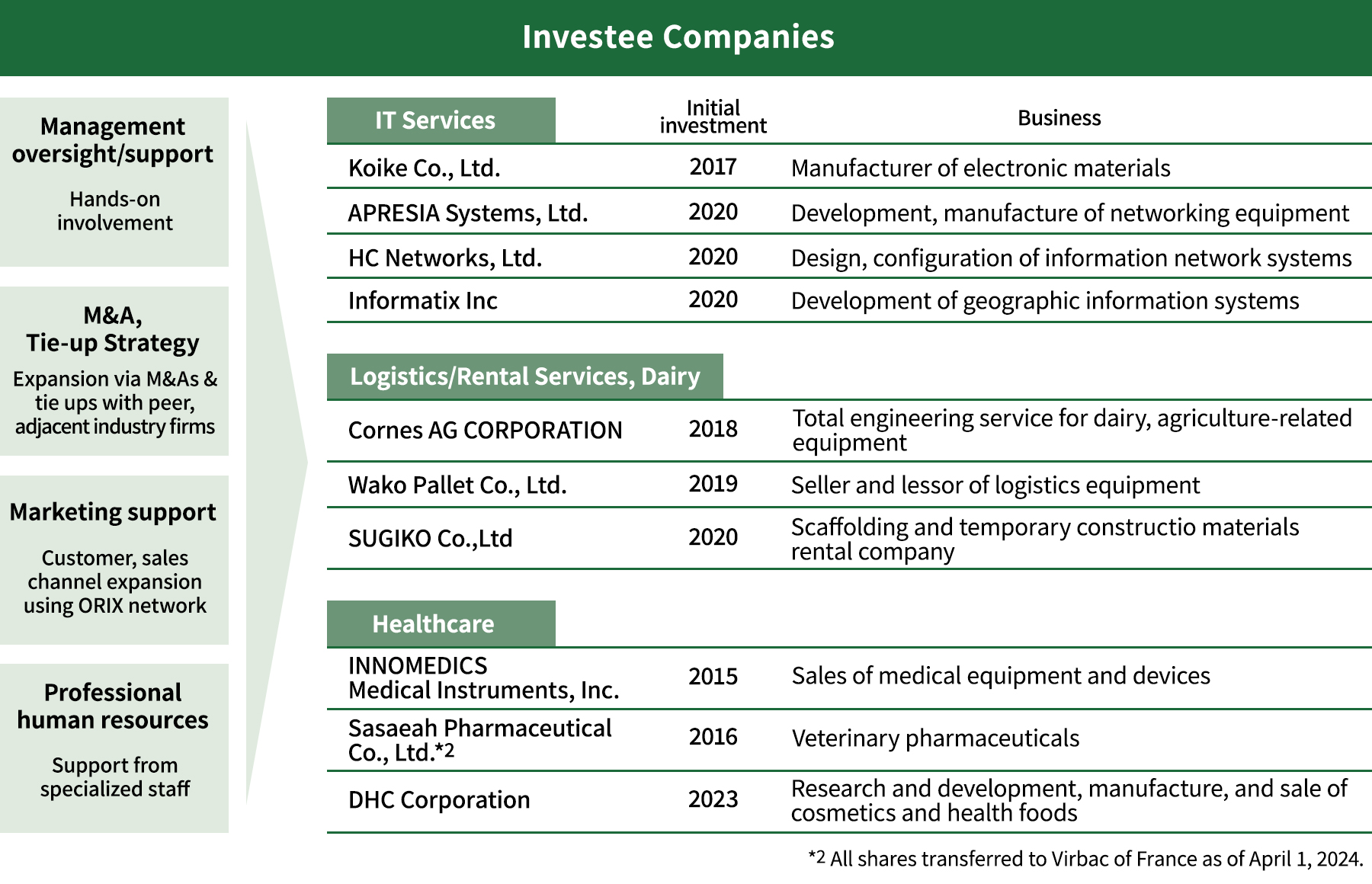

Investor That Combines the Strengths of a Fund and an Operating Company

ORIX’s PE investment business dates back to 1983, when we launched the venture capital firm ORIX Capital. We then expanded the scope of businesses in which we invested, only to weather a downturn in performance as a result of the financial crisis of 2008- 2009. We fully returned to private equity investment in the fiscal year ended March 2012. We emphasize a hands-on approach to improve all aspects of investee corporate value. This includes integrating with investee administration and providing sales support, assigning professional personnel to investees, and collaborating with the many ORIX Group divisions to develop new customers and expand sales channels.

Strengths

- Ability to add value with a hands-on approach that enhances management and administration systems and leverages synergies with ORIX Group’s sales network and products

- Flexibility in deal flow because ORIX invests its own capital

Opportunities

- Business succession needs and an increase in carve-outs, privatization, and other deals involving listed companies

- Increasing investment opportunities due to M&As aiming to improve productivity and acquire human resources, and accelerating industry reorganization

Risks

- Soaring acquisition prices and increased diffi culty in obtaining bilateral deals due to an intensifying competitive environment

- Exits at lower prices than expected resulting from the emergence of risks and investee underperformance because of poor due diligence

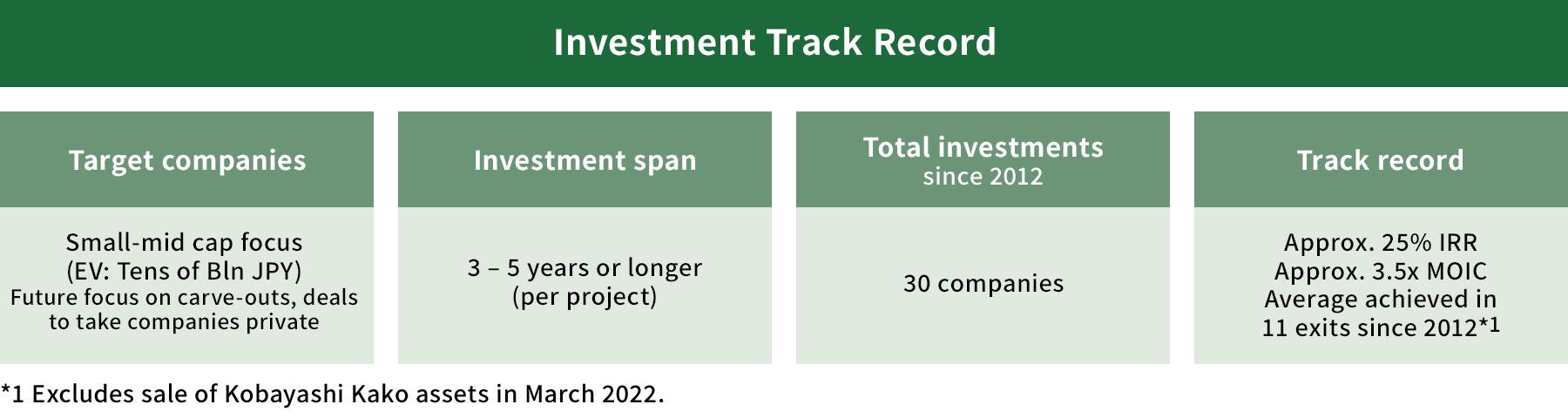

Investment Track Record

Leadership

- Leadership information updated as of June 25, 2025.

Concession

Business

Operation of airports and water businesses

| Assets | ¥34.5 billion |

|---|---|

| Profits | ¥5.4 billion |

Overview

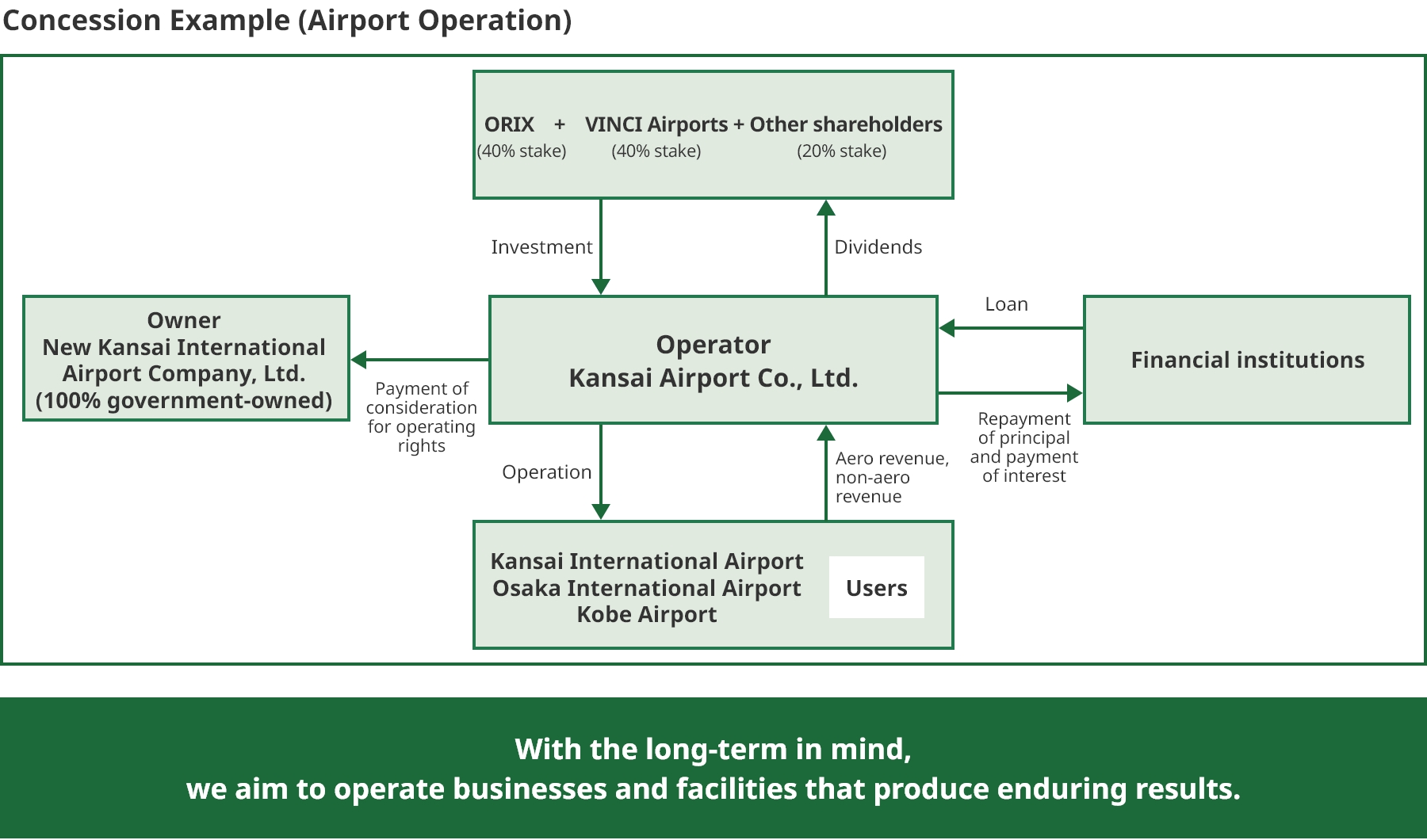

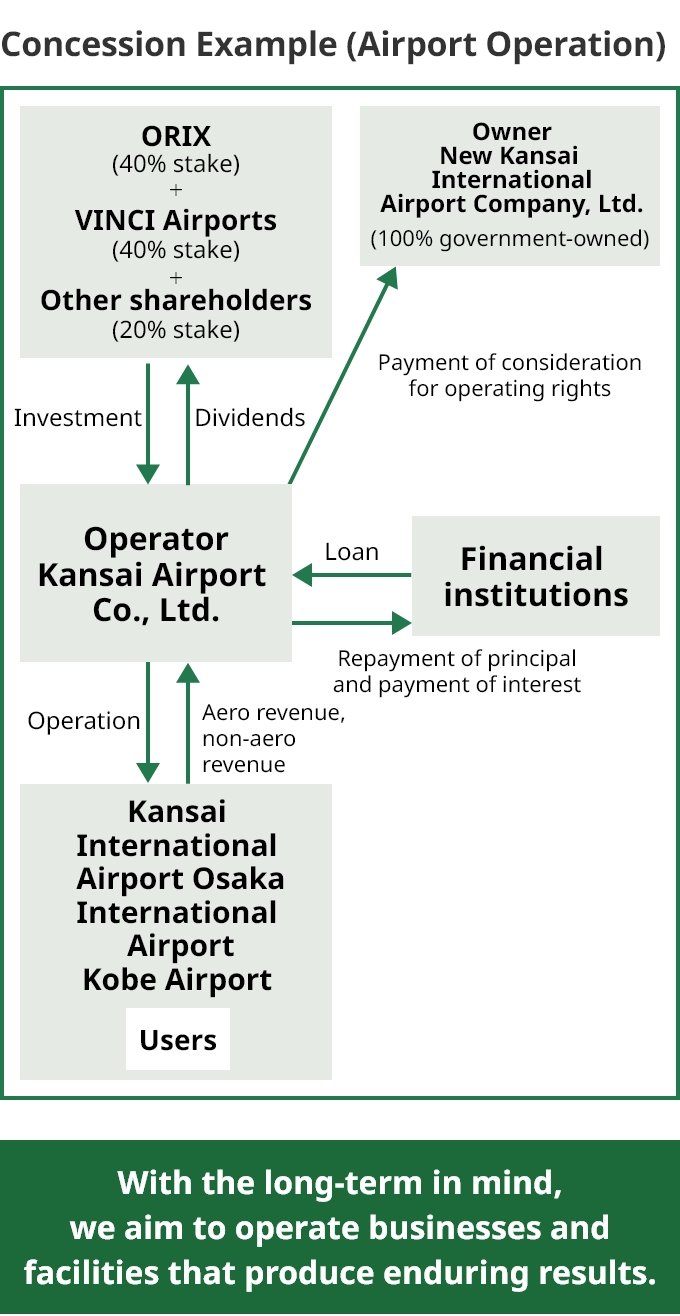

Operate Public Facilities While Public Entities Retain Ownership

We started operating Kansai International Airport and Osaka International Airport (Itami Airport) in April 2016 as the first privately owned full-scale operation business for an airport in Japan, and have been operating Kobe Airport since April 2018. All three are operated by Kansai Airport Co., Ltd., established by a consortium centered on ORIX and VINCI Airports of France. In addition, we have been operating a wastewater treatment plant in Hamamatsu City, Shizuoka Prefecture since April 2018, and water businesses (water supply, industrial waterworks, and sewerage) in Miyagi Prefecture since April 2022. ORIX participates in the operating company, which was established with METAWATER Co., Ltd. and Veolia Jenets K.K. at its core.

Strengths

- Extensive expertise and experience in business operation

- Solid network of relationships with leading companies in and outside Japan

Opportunities

- Focus in Japan on concessions as a way to resolve social issues and reduce debt

- The potential size of concession target areas

Risks

- Closure or disruption of operations due to an act of God, such as a drop in passenger volume due to a pandemic

- Changes in policies, laws, and regulations regarding concession promotion

Concession System

A system in which private enterprises are responsible for the operation of public facilities such as airports, roads, and water supply and sewage systems, while public entities retain ownership.

Leadership

- Leadership information updated as of June 25, 2025.