Banking and Credit

Information as of March 31, 2024.

Banking

Business

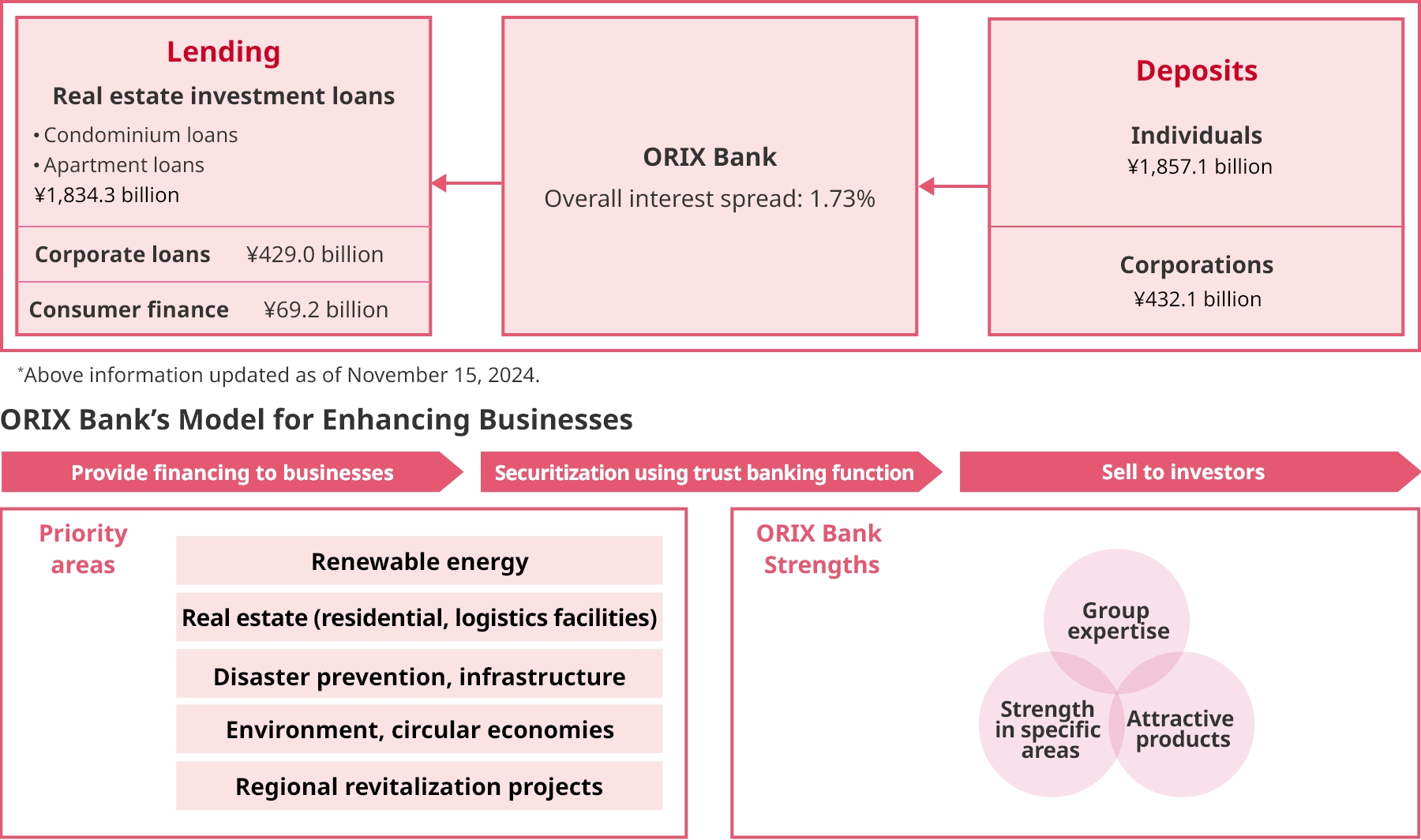

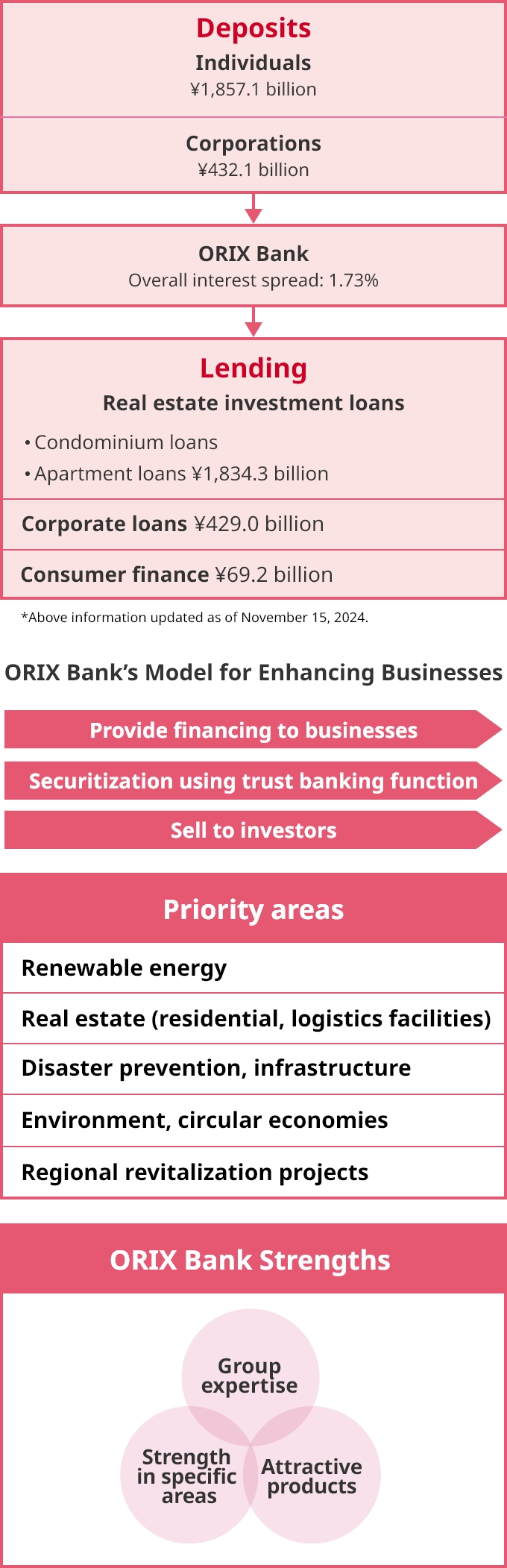

Real estate investment loans, corporate loans, consumer finance, and trust business

| Assets | ¥2573.2 billion |

|---|---|

| Profits | ¥27.6 billion |

Overview

Decades of Experience in Real Estate Investment Loans

Since joining ORIX Group in 1998, ORIX Bank has not done business like conventional banks. We do not have a branch network or ATMs, and we do not handle account settlement functions. Instead, we emphasize Internet transactions to reduce operating expenses and earn customer support with attractive interest rates on deposits. We have also expanded our business by focusing on real estate investment loans to differentiate ourselves. In these ways, we demonstrate our strengths in specialized markets. In recent years, we have been developing new products and services that leverage trust banking functions to address the asset management and succession needs of our customers.

Strengths

- High profitability from efficient operations with demonstrated strength in clearly defined markets

- Able to provide diverse products and services using trust banking functions

Opportunities

- Growing demand for funding for corporate sustainability initiatives

- Strong investor appetite in the real estate investment market

- Diversifying customer needs for asset management and administration

Risks

- Aggressive sustainability-related investments and loans by other fi nancial institutions

- Contraction in the core real estate investment loan market due to rising real estate and construction prices

- Rise in market volatility and emergence of credit risk associated with interest rate and price hikes and monetary policy trends

ORIX Bank’s Business Model

Leadership

- Yuichi Nishigori

-

Representative Director and Chairman, ORIX Bank Corporation

- Kanji Teramoto

-

Representative Director and President, ORIX Bank Corporation

- Leadership information updated as of April 1, 2025.