Aircraft and Ships

Information as of March 31, 2024.

Aircraft and Ships

Business

Leasing and asset management services for aircraft and ships

| Assets | ¥1,058.4 billion |

|---|---|

| Profits | ¥26.8 billion |

Overview

Expertise Acquired over Four Decades

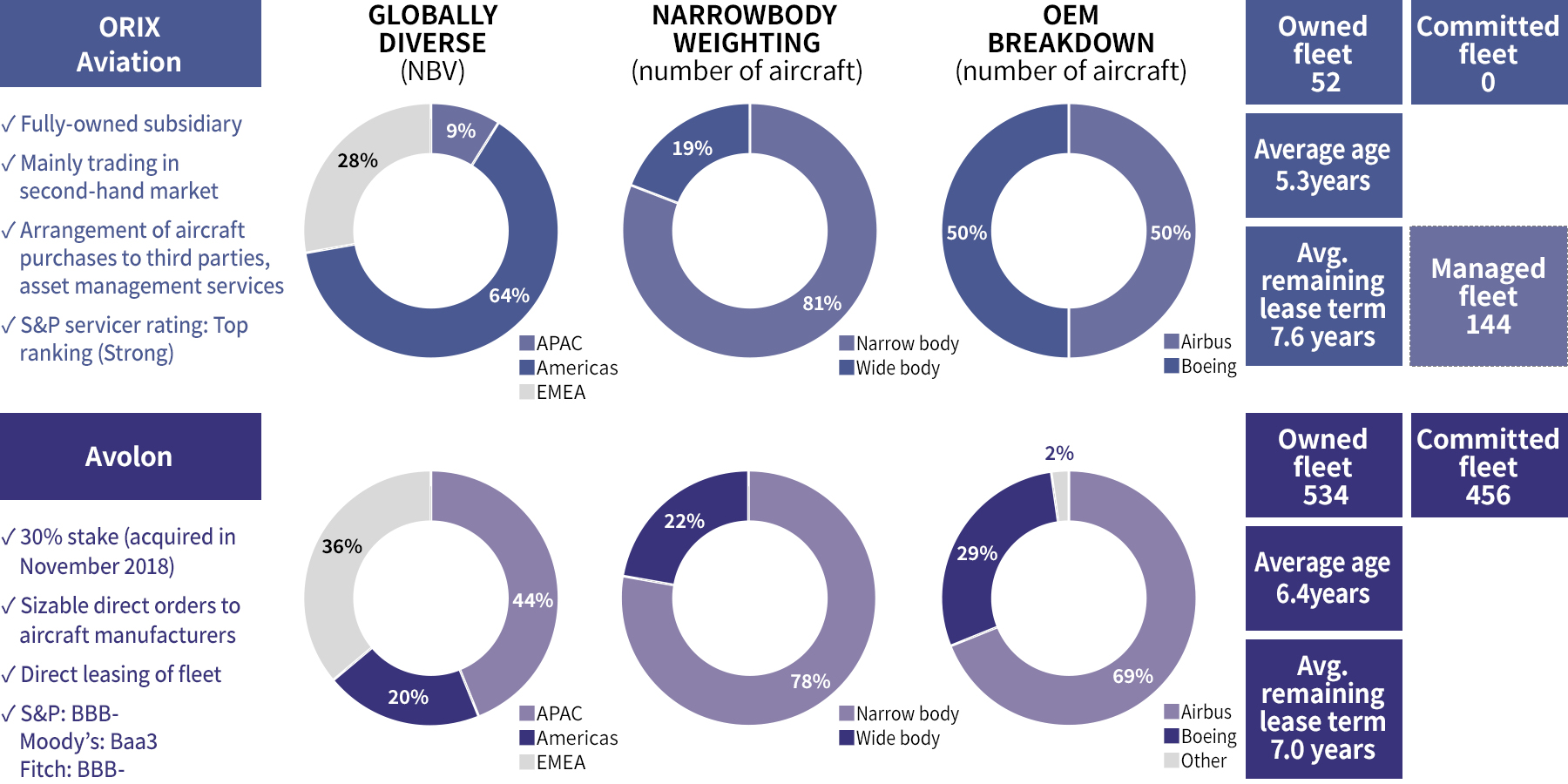

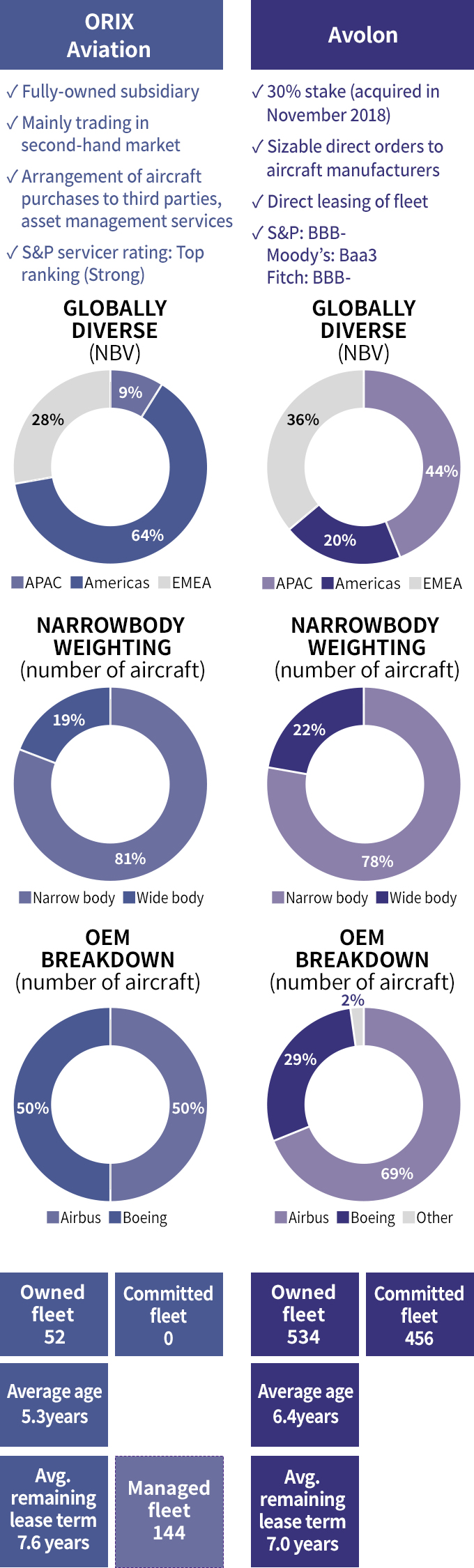

Aircraft business: We entered the aircraft financing business in 1978 and entered the aircraft operating lease business with the establishment of an aircraft leasing company in Ireland in 1991. In addition to leasing owned aircraft, we provide domestic and overseas investors with asset management services including aircraft investment arrangements and aircraft sale and re-lease.

Moreover, in 2018 we took a 30% stake in Avolon Holdings Limited, the world’s third-largest aircraft leasing company.

Ship business: ORIX entered the ship leasing business in 1971 and has owned ships since the 1980s, investing in ships and chartering them to Japanese and international shipping companies. We have accumulated a wide range of know-how related to ship financing, the management and operation of ships we own, and ship trading and brokerage.

Strengths

Aircraft Business

- Aircraft sourcing ability and high-quality asset management services

- Avolon’s business model of ordering from aircraft manufacturers

Ship Business

- Ship operations and management (Santoku Senpaku, ORIX Maritime)

- Diversified portfolio encompassing owned vessels, financing, and fee businesses

Opportunities

Aircraft Business

- Increased use of leasing among airlines and increase in low-cost carriers

- Greater demand for aircraft remarketing and asset management

Ship Business

- Increased logistics demand worldwide

- Investment to decarbonize and digitally transform shipping

Risks

Aircraft Business

- Decrease in passenger demand due to a global economic slowdown, war, terrorism, or infectious diseases

- Airline bankruptcies

Ship Business

- Decrease in the volume of trade due to accelerating protectionism caused by geopolitical risk (decrease in volume of goods shipped internationally)

- Decrease in investor demand due to a global economic slowdown

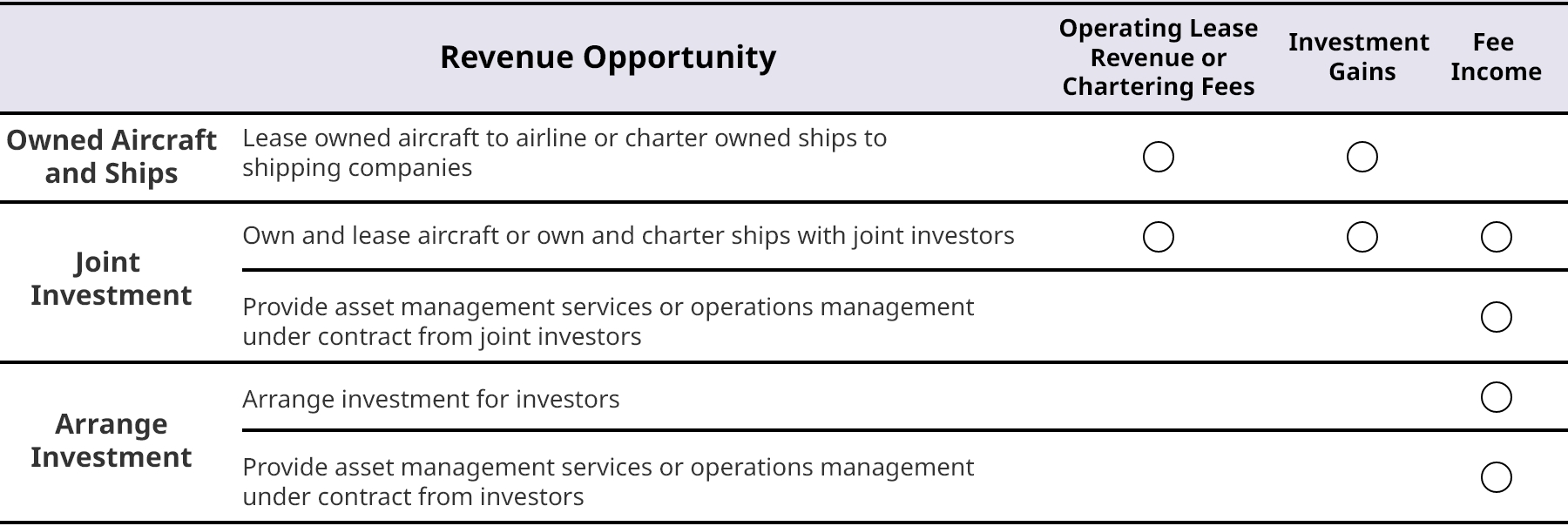

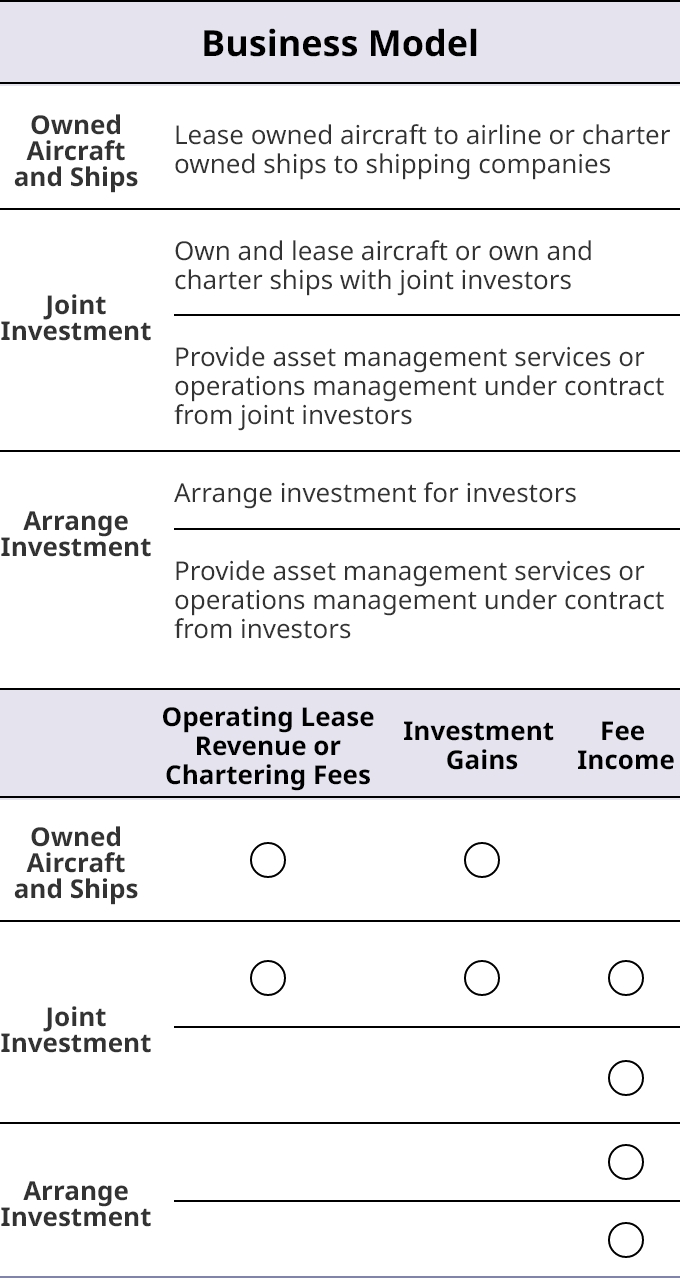

Revenue Opportunities for Aircraft and Ships

Comparative Aircraft Leasing Business Overview

Leadership

- Leadership information updated as of January 1, 2025.