News Release

Release of New Product:

U.S. Dollar-Denominated Whole Life Insurance “Candle Wide”

Sep 02, 2020

TOKYO, Japan - September 2, 2020 - ORIX Life Insurance Corporation (hereinafter referred to as “ORIX”) is pleased to announce that it will release U.S. dollar-denominated whole life insurance “Candle Wide” (hereinafter referred to as “the product”) on October 2, 2020.

The product is a whole life insurance that ensures security for death and disability for a lifetime and enables the insured to prepare broadly for various risks that can arise during insureds’ lifetime, such as specified diseases (cancer (malignant neoplasm), myocardial infarction, and cerebral stroke), physical disabilities, and nursing care.

The product invests in U.S. dollars that have relatively high interest rates compared to Japanese yen. In addition, it ensures security with comparatively low premiums and enables high savings after the premium payment period by keeping the insurance benefits and cash surrender value relatively low during the premium payment period.

In April 2019, ORIX released its first foreign currency-denominated insurance, U.S. dollar-denominated whole life insurance “Candle,” which has been well received by many customers. This time, as its second foreign currency-denominated product, ORIX will launch the product, which covers a broad range of risks in living the 100-year life, thereby creating a product lineup that can further respond to the diversifying lifestyles and needs of customers.

ORIX will provide a variety of products that meet the needs of the age, and will strive to continue to be an insurance company chosen by many customers.

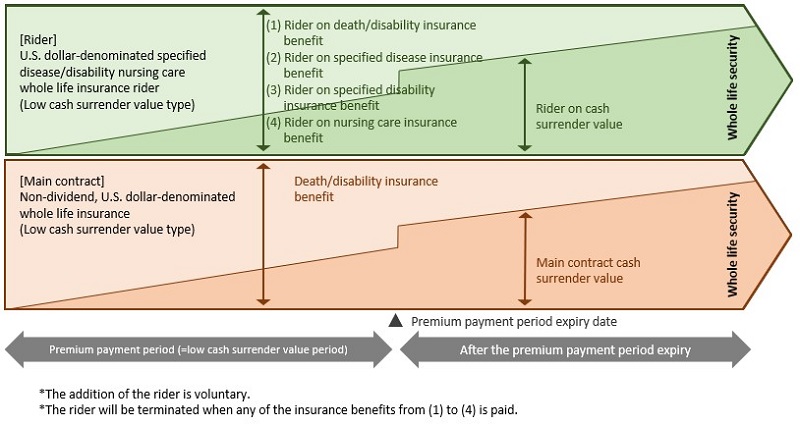

<Product structure>

[Key characteristics of U.S. dollar-denominated whole life insurance “Candle Wide”]

■ Candle Wide is a whole life insurance to ensure security for death and disability.

■ Candle Wide makes an investment in U.S. dollars that have relatively high interest rates compared to Japanese yen.

■ Candle Wide provides security at comparatively low premiums and enables high savings after the premium payment period, by keeping the cash surrender value relatively low during the premium payment period.

■ When the insured falls under the category of specified diseases (cancer (malignant neoplasm), myocardial infarction, and cerebral stroke) or specified disabilities, or the state requiring nursing care prescribed in the policy, the insured can receive a rider insurance benefit and be exempted from paying subsequent insurance premiums.

* When the specified disease/disability nursing care whole life insurance rider is added and the specified disease/disability nursing care insurance premium payment exemption special provision is applied

■ Insurance premiums will be paid in yen, and benefits and cash surrender value will be received in either yen or U.S. dollars.

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

About ORIX:

ORIX Corporation (TSE: 8591; NYSE: IX) is a financial services group which provides innovative products and services to its customers by constantly pursuing new businesses.

Established in 1964, from its start in the leasing business, ORIX has advanced into neighboring fields and at present has expanded into lending, investment, life insurance, banking, asset management, automobile related, real estate and environment and energy related businesses. Since entering Hong Kong in 1971, ORIX has spread its businesses globally by establishing locations in 37 countries and regions across the world.

Going forward, ORIX intends to utilize its strengths and expertise, which generate new value, to establish an independent ORIX business model that continues to evolve perpetually. In this way, ORIX will engage in business activities that instill vitality in its companies and workforce, and thereby contribute to society. For more details, please visit our website: https://www.orix.co.jp/grp/en/

(As of March 31, 2020)

Caution Concerning Forward Looking Statements:

These documents May contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results that differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “(4) Risk Factors” of the “1. Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2020 – March 31, 2020.”

- View PDF of this release

- PDF

[182KB]

[182KB]

- PDF