News Release

ORIX Bank Begins Offering Real Estate Investment Loans that Accommodate Family Trusts

Support services for future property management and asset succession ranging from consulting on family trusts to financing arrangements

Aug 08, 2019

TOKYO, Japan - August 8, 2019 - ORIX Bank Corporation (“ORIX Bank”) announced that it will start offering real estate investment loans for entrusted property*1 (referred to as “Loan in trust schemes”) placed in family trusts that enter into agreements with family members to support efficient property management and asset succession.

Family trusts are a system of civil trusts that enable a settlor (the individual who entrusts property) to prepare for a decline in competency due to dementia or other conditions by putting their assets in the care of a trustee (a trusted family member). This scheme enables management, operation, or disposal of entrusted property by the trustee even in the event the settlor losses the ability to make decisions regarding property management and asset succession, making possible property management that protects the livelihoods of both the settlor and family members and efficient succession of assets in accordance with the settlor’s intentions.

Since management and operation of entrusted property by the trustee can extend over a long period of time, various financing needs for purposes such as building, purchasing, or renovating investment real estate can be expected to arise. ORIX Bank has started offering Loan in trust schemes, enabling the provision of loans to trustees who intended to lease real estate, supporting the management and operation of entrusted property.

On September 18, 2018, ORIX Bank began offering a Family Trust Support Service*2. This service provides proposals for property management structures that best fit the customer’s needs through in-person consultations by counselors based on comparisons of family trusts, the adult guardianship system, wills, and other schemes, and e-Direct Deposit Accounts (with family trust deposit rider), which are trust accounts specifically for separate management of entrusted property. With the launch of Loan in trust schemes, ORIX Bank will provide comprehensive support services to customers who have concerns about dementia and other health issues and are worried about property management and asset succession.

In Japan, greater longevity has brought about an “aging of financial assets” as the proportion of personal assets held by the elderly continues to grow. At the same time, indicators are that by 2025, one in five people aged 65 years and older will develop dementia*3, and the value of financial assets held by persons with dementia is forecast to grow from 143 trillion yen as of the end of 2017 to 215 trillion yen in 2030*4, requiring early measures to be taken for property management and asset succession by individuals.

ORIX Bank will continue working to create new products and services that meet the needs of customers that change with the times.

*1 Use of funds will be restricted by the purpose of trust agreement.

*2 A minimum fee of 540,000 yen (including tax) will be applicable.

*3 Source: Cabinet Office, Annual Report on the Aging Society: 2017

*4 Source: Excerpted from Dai-ichi Life Research Institute Inc., “The Future of 200 Trillion in Financial Assets held by Persons with Dementia; Projected to Account for 10% Household Financial Assets in FY2030”

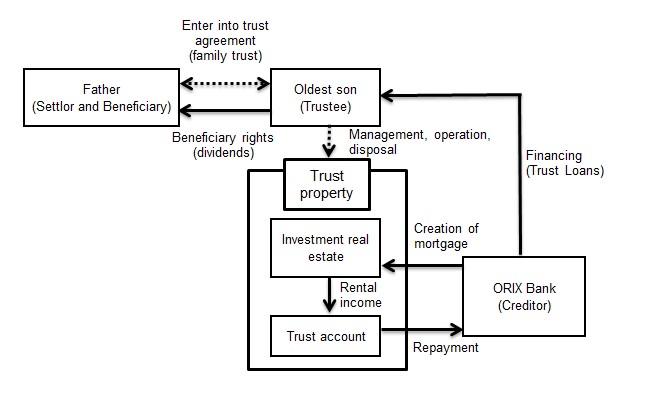

■ An example of a Loan in trust schemes (loan for renovation/large-scale repair work)

(1) Settlor enters into a trust agreement with a trusted family member (trustee) and performs trust registration of the investment real estate as trust property. Trustee performs real estate lease management including management, operation, and disposal of the investment real estate in accordance with the trust agreement.

(2) Trustee can obtain financing if expenses are incurred such as expenses for renovation and large-scale repairs in the course of the real estate lease management. Creditors create a mortgage on the investment real estate, which is trust property, and disburse loans to trustee according to the intended use.

(3) Trustee manages rental income in trust accounts and make repayments of loans.

(4) Proceeds from trust property (rental income) is attributable to the beneficiary.

* In the event the father, who is settlor and beneficiary, losses the ability to make decisions due to dementia or other condition, management, operation, and disposal of the investment real estate for can be carried out by the trustee.

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

About ORIX:

ORIX Corporation (TSE: 8591; NYSE: IX) is a financial services group which provides innovative products and services to its customers by constantly pursuing new businesses.

Established in 1964, from its start in the leasing business, ORIX has advanced into neighboring fields and at present has expanded into lending, investment, life insurance, banking, asset management, automobile related, real estate and environment and energy related businesses. Since entering Hong Kong in 1971, ORIX has spread its businesses globally by establishing locations in 37 countries and regions across the world.

Going forward, ORIX intends to utilize its strengths and expertise, which generate new value, to establish an independent ORIX business model that continues to evolve perpetually. In this way, ORIX will engage in business activities that instill vitality in its companies and workforce, and thereby contribute to society. For more details, please visit our website: https://www.orix.co.jp/grp/en/

(As of March 31, 2019)

Caution Concerning Forward Looking Statements:

These documents May contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results that differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “(4) Risk Factors” of the “1. Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2018 – March 31, 2019.”

- View PDF of this release

- PDF

[117KB]

[117KB]

- PDF