News Release

Release of New Product:

U.S. Dollar-Denominated Whole Life Insurance “Candle”

―Foreign currency-denominated whole life insurance with an investment in U.S. dollars added to the product lineup―

Mar 12, 2019

TOKYO, Japan – March 12, 2019 – ORIX Life Insurance Corporation (hereinafter referred to as “ORIX”) is pleased to announce that it will release U.S. dollar-denominated whole life insurance “Candle” (non-dividend, designated currency-denominated special whole life insurance [low cash surrender value type], hereinafter referred to as “the product”) on April 2, 2019.

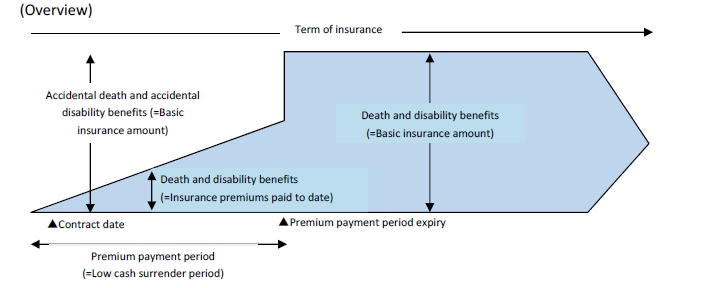

The product is a U.S. dollar-denominated level premium whole life insurance that ensures the security for death and disability for a lifetime. It invests in U.S. dollars that have relatively high interest rates compared to Japanese yen. In addition, it ensures the security for a lifetime with comparatively low premiums and enables high savings after the premium payment period by keeping the insurance benefits and cash surrender value relatively low during the premium payment period.

With the arrival of the 100-year life, as well as with the progress of the review of the social security system due to the advancement of the falling birth rate and the aging population, an individual's self-help efforts increasingly become important in order to build up assets, taking a long life into consideration. In such an age, ORIX has developed the product to satisfy the needs of customers who hope to ensure the security for a lifetime and build up assets in a rational manner.

Going forward, ORIX will provide a variety of products in each area of death security, health security and asset building, which meet the needs of the age, and will strive to continue to be an insurance company chosen by many customers.

| <Key characteristics of U.S. dollar-denominated whole life insurance “Candle”> ■ Candle is a whole life insurance to ensure the security for death and disability. ■ Candle makes an investment in U.S. dollars that have relatively high interest rates compared to Japanese yen. ■ Candle enables comparatively low premiums and high savings after the premium payment period, by keeping the benefits for death and disability due to causes other than a disaster as well as cash surrender value relatively low during the premium payment period. ■ An application can be made after disclosing two items related to health conditions. ■ Insurance premiums may be paid in yen, and benefits and cash surrender value may be received in either yen or U.S. dollars. |

<Product structure>

| Insurance benefits | Cause for payment | Payment amount | |

|---|---|---|---|

| During the premium payment period |

Death insurance benefits | When the insured dies (excluding the case where an accidental death benefit is paid) |

Insurance premiums paid to date |

| Disability insurance benefits | When the insured falls under the category of disability prescribed in the policy conditions caused by disease or injury (excluding the case where an accidental disability benefit is paid) |

||

| Accidental death benefits | When the insured dies in an unexpected accident or from an infectious disease | Basic insurance amount | |

| Accidental disability benefits | When the insured falls under the category of disability prescribed in the policy conditions caused by an unexpected accident or infectious disease | ||

| After the premium payment period |

Death insurance benefits | When the insured dies | |

| Disability insurance benefits | When the insured falls under the category of disability prescribed in the policy conditions caused by disease or injury |

| Cash surrender value | During the low cash surrender value period, the cash surrender value is reduced to 70% of the full cash surrender value. * The low cash surrender value period is the same as the premium payment period. |

|---|---|

| Term of insurance | Whole life |

| Insurance age | 15 years old – 80 years old (insurance age eligibility depends on established premium payment period) |

| Payment method | Account transfer or credit card payment |

| Insurance amount | Minimum insurance amount: USD 30,000 Maximum insurance amount: USD 5,000,000 (not exceeding JPY 500,000,000) |

| Main riders that can be added | Riders on payment in yen, riders on receipt in yen, riders on living needs (for designated currency-denominated and foreign currency-denominated), riders on prepayment for nursing care (for designated currency-denominated and foreign currency-denominated), riders on claims by assignees, riders on pension payment |

<Disclosure of health-related information>

| 1 | Within the past five years, have you had a diagnosis, checkup, treatment or medication by a doctor with regard to a cancer or intraepithelial neoplasm (*)? * Cancer refers to malignant neoplasm, including cancer, leukemia, sarcoma, myeloma and malignant lymphoma. Intraepithelial neoplasm includes high-grade dysplasia and intraepithelial cancer. |

|---|---|

| 2 | Do you have any one of the following disabilities? ● Visual, hearing or language disability, or masticatory function impairment ● Spinal deformity or disorder ● Loss of a hand, foot or finger, or functional impairment |

* In addition to the disclosure of health-related information, there are cases when you may not enter into a contract for insurance due to reasons such as restrictions on occupation.

<Examples of insurance premiums>

| Sex | Insurance age | Monthly insurance premiums |

|---|---|---|

| Male | 30 years old | USD 116.50 |

| 40 years old | USD 200.20 | |

| 50 years old | USD 468.20 | |

| Female | 30 years old | USD 104.80 |

| 40 years old | USD 179.40 | |

| 50 years old | USD 418.60 |

| Sex | Insurance age | Monthly insurance premiums |

|---|---|---|

| Male | 30 years old | USD 321.50 |

| 40 years old | USD 389.00 | |

| 50 years old | USD 468.20 | |

| Female | 30 years old | USD 286.90 |

| 40 years old | USD 346.70 | |

| 50 years old | USD 418.60 |

<Notes>

■ Foreign exchange risk

This insurance is exposed to foreign exchange risks.

● This insurance is U.S. dollar-denominated. When insurance premiums, insurance amount, cash surrender value, etc., are converted to yen, they are affected by changes in exchange rates.

・ Due to changes in exchange rates, the yen equivalent of insurance amount or cash surrender value to be received may fall below the total insurance premiums paid in yen, resulting in a loss.

・ Due to changes in exchange rates, the yen equivalent of insurance amount or cash surrender value to be received may fall below the yen equivalent of insurance premiums and cash surrender value when a contract was entered into, resulting in a loss.

* Even if there were no changes in exchange rates, the amount to be received may fall below the total amount of insurance premiums paid because exchange fees are deducted.

● Since the riders on payment in yen have already been added to this insurance contract, insurance premiums, etc., can be paid in yen (they may not be paid in U.S. dollars). The insurance premiums will increase or decrease depending on changes in exchange rates as prescribed by ORIX.

● If riders on receipt in yen are added and insurance premiums, cash surrender value, etc., are received in yen, they are affected by changes in exchange rates as prescribed by ORIX.

● The exchange risks relating to this insurance contract attribute to policyholders and the assured.

■ Expenses

There are various expenses ORIX will ask you to pay with regard to this insurance.

The expenses include the following:

● Expenses that are deducted from insurance premiums:

Expenses, etc., related to execution and maintenance of insurance contracts, death security, etc., are deducted from insurance premiums paid. Since these expenses differ depending of insurance age, sex, etc., a uniform calculation method cannot be stated.

● Expenses when insurance premiums, etc., are paid:

The riders on payment in yen has already been added to this insurance contract. The exchange rates prescribed by ORIX (TTM + 0.01 yen / USD 1 of the bank designated by ORIX as an index), which are applied to insurance premiums, etc., when they are paid in yen, include exchange fees.

● Expenses when insurance premiums, cash surrender value, etc., are received in yen:

Under this insurance contract, insurance premiums, cash surrender value, etc., can be received in yen by adding riders on receipt in yen. The exchange rates prescribed by ORIX (TTM - 0.01 yen / USD 1 of the bank designated by ORIX as an index), which are applied in such a case, include exchange fees.

* Exchange rates prescribed by ORIX are those as of April 2019 and may be changed in the future.

● Expenses when insurance premiums, cash surrender value, etc., are received in U.S. dollars:

Various fees (e.g., lifting charge) may be required by some financial institutions. Please check with the financial institutions you use with regard to the amount of such fees, payments, and so on.

● Expenses when the insurance contract is cancelled or the insurance amount is reduced:

When the insurance contract is cancelled or the insurance amount is reduced, for the period of ten years from the date of contract, the predetermined amount is deducted from the policy reserve depending on the period elapsed (the number of months in which insurance premiums were paid). Since the amount to be deducted differs depending on the period elapsed, etc., a uniform calculation method cannot be stated.

● Expenses if the insurance amount is received from a pension (in case that riders on pension are added):

After the commencement date of pension payment, 1.0% (as of April 2019) of the pension benefit is deducted from the pension fund on the pension payment date.

* These materials describe the outline of the product. When reviewing life insurance contracts, please be sure to check the product booklet, policy leaflet, policy provisions, documents issued before entering into a contract (overview of the contract and information calling for attention), and so on.

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

About ORIX:

ORIX Corporation (TSE: 8591; NYSE: IX) is a financial services group which provides innovative products and services to its customers by constantly pursuing new businesses.

Established in 1964, from its start in the leasing business, ORIX has advanced into neighboring fields and at present has expanded into lending, investment, life insurance, banking, asset management, automobile related, real estate and environment and energy related businesses. Since entering Hong Kong in 1971, ORIX has spread its businesses globally by establishing locations in 38 countries and regions across the world.

Going forward, ORIX intends to utilize its strengths and expertise, which generate new value, to establish an independent ORIX business model that continues to evolve perpetually. In this way, ORIX will engage in business activities that instill vitality in its companies and workforce, and thereby contribute to society. For more details, please visit our website: https://www.orix.co.jp/grp/en/

(As of September 30, 2018)

Caution Concerning Forward-Looking Statements:

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results that differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “(4) Risk Factors” of the “1. Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2017 – March 31, 2018.”

- View PDF of this release

- PDF

[153KB]

[153KB]

- PDF