News Release

Three Banks of the Yamaguchi Financial Group Commence Handling of Testamentary Substitute Trust “Gift to the Family”

Signing of operating agreement with ORIX Bank to act as agents for trust agreements

Jan 25, 2019

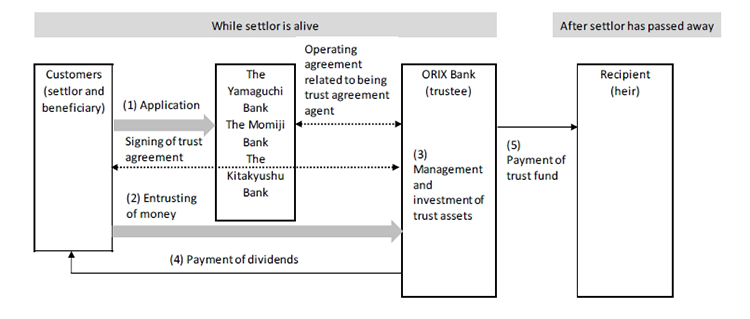

TOKYO, Japan — January 25, 2019 — ORIX Bank Corporation has signed an operating agreement with The Yamaguchi Bank, Ltd., The Momiji Bank, Ltd., and The Kitakyushu Bank, Ltd.—subsidiaries of the Yamaguchi Financial Group, Inc.—to act as agents for trust agreements. Through this agreement, the three banks under the Yamaguchi Financial Group will start handling the testamentary substitute trust “Gift to the Family” from February 4, 2019.

The testamentary substitute trust “Gift to the Family” is a product that pays out money to a designated recipient (heir), such as family members of the customer, at the time of inheritance, with the three banks of the Yamaguchi Financial Group acting as the intermediaries between the customers (settlor and beneficiary) and ORIX Bank for the signing of trust agreements.

Going forward, the Yamaguchi Financial Group and ORIX Bank will continue to work on providing even better products and improving services so as to widely respond to the diverse asset inheritance requests of customers.

1. Features of this product

(1) It is possible for assets to be inherited without having to bear the burden of creating a will as the product has the same function of “designating asset inheritance to a specific family member” as a will.

(2) It is possible for the pre-designated recipient (heir), such as family members, to inherit assets without having to wait for inheritance procedures to be completed.

(3) As it is a principal-guaranteed product, it can be used with peace of mind to pass on assets to recipients (heir) such as family members.

2. Service commencement

February 4, 2019

3. Service overview

| Name | “Gift to the Family” |

|---|---|

| Target | Individuals (settlor and beneficiary) |

| Trust type | Jointly-managed designated money trust |

| Trust period | Maximum of 30 years from the time the trust is established |

| Application units | From 1 million to 30 million yen (in multiples of 1 million yen), providing that the amount is no more than one-third of the financial assets held by the customer |

| Investment method | Bank account loans, etc. |

| Payment method | Lump sum payment |

| Principal compensation, etc. | Compensation should there be a loss in the trust principal |

| Deposit insurance system | Product applicable for deposit insurance |

| Agents | All branches of The Yamaguchi Bank, The Momiji Bank, and The Kitakyushu Bank in Japan (excluding sub-branches at municipal offices) |

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

About ORIX:

ORIX Corporation (TSE: 8591; NYSE: IX) is an opportunistic, diversified, innovation‐driven global powerhouse with a proven track record of profitability. Established in 1964, ORIX at present operates a diverse portfolio of businesses in the operations, financial services, and investment spaces. ORIX’s highly complementary business activities span industries including: energy, private equity, infrastructure, automotive, ship and aircraft, real estate and retail financial services. ORIX has also spread its business globally by establishing locations in a total of 38 countries and regions across the world. Through its business activities, ORIX has long been committed to corporate citizenship and environmental sustainability. For more details, please visit our website: https://www.orix.co.jp/grp/en/

(As of September 30, 2018)

Caution Concerning Forward-Looking Statements:

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results that differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “(4) Risk Factors” of the “1. Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2017 — March 31, 2018.”

- View PDF of this release

- PDF

[116KB]

[116KB]

- PDF