News Release

ORIX and Kanagawa Bank to Cooperate on Asset-Based Lending for Commercial Vehicles

Sep 23, 2016

TOKYO, Japan - September 23, 2016 - ORIX Corporation ("ORIX"), a leading integrated financial services group, and ORIX Auto Corporation ("ORIX Auto"), a subsidiary of ORIX Corporation, announced today the conclusion of an agreement with The Kanagawa Bank, Ltd. ("Kanagawa Bank," also abbreviated as "KANAGIN") for asset-based lending ("ABL") using commercial vehicles as collateral. Kanagawa Bank will begin offering its "KANAGIN Truck Collateral Loan" from October 3, 2016. This type of ABL scheme using commercial vehicle as collateral will be the first of its kinds being offered by a financial institution in Kanagawa Prefecture.

With the "KANAGIN Truck Collateral Loan," Kanagawa Bank will provide corporate clients and sole proprietors lending for working capital or the new vehicle purchase using currently-owned trucks, buses and other commercial vehicles as collateral. ORIX Auto will appraise the value of the commercial vehicles and set the level of collateral, and will provide loan guarantees.

Unlike the conventional loans backed by land or other real estate, this type of ABL helps to broaden funding options for corporate clients and sole proprietors, and hence the use of ABL is expected to grow in the future.

To date, ORIX has partnered with 184 financial institutions to provide guarantees for unsecured loans and ABL, and is expanding its financial services that capitalize on its credit and collateral valuation expertise. ORIX Auto, meanwhile, has sophisticated vehicle expertise, with approximately 1.23 million vehicles under management as of March 31, 2016, and a track record of selling approximately 90,000 used leased and rental vehicles annually.

Kanagawa Bank began offering its first ABL, in the form of loans collateralized with wholesale food industry marine products, in August of 2008. Since then, it has worked as a community-based financial institution to provide optimal solutions by responding quickly and flexibly to a wide range of requirements among its small- and medium-sized enterprise (SME) clients.

Going forward, Kanagawa Bank and ORIX Group will continue to leverage their respective expertise as they provide financial services that respond to a variety of SME customer needs.

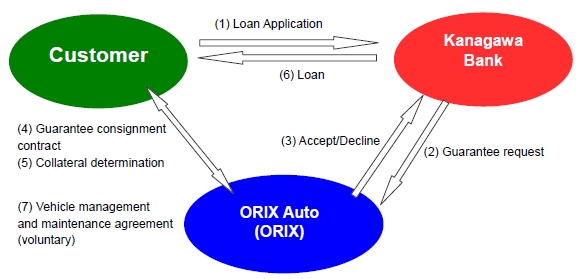

Framework of the "KANAGIN Truck Collateral Loan"

(1) The customer applies for a loan to Kanagawa Bank

(2) Kanagawa Bank asks ORIX Auto to guarantee the loan

(3) ORIX Auto responds to Kanagawa Bank's request for a guarantee

(4) ORIX Auto and the customer sign a guarantee consignment contract

(5) ORIX Auto determines the collateral for the customer's vehicle (reservation of ownership)

(6) Kanagawa Bank extends financing to the customer

(7) ORIX Auto and the customer sign a vehicle management and maintenance service agreement (voluntary)

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

About ORIX:

ORIX Corporation (TSE: 8591; NYSE: IX) is an opportunistic, diversified, innovation-driven global powerhouse with a proven track record of profitability. Established in 1964, ORIX at present operates a diverse portfolio of businesses in the operations, financial services, and investment spaces. ORIX's highly complementary business activities span industries including: energy, private equity, infrastructure, automotive, ship and aircraft, real estate and retail financial services. ORIX has also spread its business globally by establishing locations in a total of 37 countries and regions across the world. Through its business activities, ORIX has long been committed to corporate citizenship and environmental sustainability. For more details, please visit our website: http://www.orix.co.jp/grp/en/

Caution Concerning Forward Looking Statements:

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under "Risk Factors" in the Company's annual report on Form 20-F filed with the United States Securities and Exchange Commission and under "4. Risk Factors" of the "Summary of Consolidated Financial Results" of the "Consolidated Financial Results April 1, 2015 - March 31, 2016."

- View PDF of this release

- PDF

[73KB]

[73KB]

- PDF