News Release

ORIX Enters Alliance with Tohoku Bank for Contractor Guarantee Factoring Service

- First Alliance with a Financial Institution in the Tohoku Region -

Sep 01, 2011

TOKYO, Japan – September 1, 2011 – ORIX Corporation (TSE: 8591; NYSE: IX), a leading integrated financial services group, announced today that it entered into an alliance with Iwate Prefecture-based Tohoku Bank., Ltd. (hereinafter “Tohoku Bank”), and will expand its Contractor Guarantee Factoring Service to Tohoku Bank clients.

Applications for this service will be accepted at the main office and other branches of Tohoku Bank starting on September 1. This is the first time ORIX has entered into an alliance with a financial institution in the Tohoku region for the provision of this service.

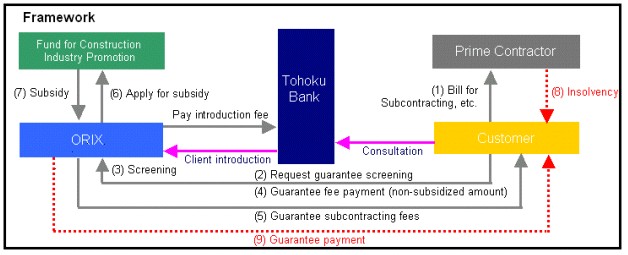

Guarantee factoring is a service based on the Ministry of Land, Infrastructure, Transport and Tourism’s system where support providers guarantee subcontractor accounts receivable (hereinafter “subcontractor guarantee system”). Under this service, ORIX, upon screening the prime contractor*1, guarantees credit obligations such as construction expenses and accounts receivable of the prime contractor held by clients such as subcontractors and materials suppliers.

Clients are able to hedge the risk of uncollected expenses from prime contractors by paying ORIX a set guarantee fee. In addition, as a portion of the guarantee fee paid to ORIX is subsidized by the Fund for Construction Industry Promotion, the client can enter into an agreement by only paying the difference of the guarantee fee and subsidy.

ORIX was authorized by the Ministry of Land, Infrastructure, Transport and Tourism as a guarantee factoring provider under the subcontractor guarantee system in March 2010. ORIX aims to further expand this service to a broader range of customers by promoting alliance with regional financial institutions with strong network in their local regions.

ORIX will continue to promote alliances and cooperation in a variety of areas and provide financial services that meet a wide range of client needs.

Details of the Alliance with Tohoku Bank

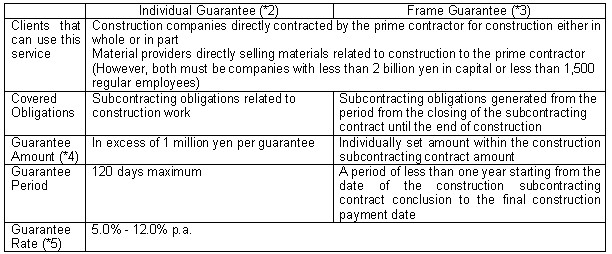

*1: If the prime contractor meets certain criteria such as undertaking a management review, obligations to the subcontractor are guaranteed regardless of the subcontractor tier. For example, credit obligations of a second tier contractor held by a third tier subcontractor may be covered.

*2: Individual obligations are guaranteed.

*3: The upper limit of the guarantee is set for each construction project and all obligations within this limit that result within the construction period are guaranteed.

*4: The guarantee amount is set after a screening of the primary contractor and client and there may be instances where the guarantee amount is not in line with the requested amount.

*5: The guarantee rate includes the system use rate (1.0% p.a.) and subsidy. ORIX will pay the system use rate to the Fund for Construction Industry Promotion on behalf of the client.

Reference: Ministry of Land, Infrastructure, Transport and Tourism subcontractor guarantee system (In Japanese)

URL:http://www.mlit.go.jp/sogoseisaku/const/sosei_const_tk2_000033.html![]()

Contact Information

ORIX Corporation, Investor Relations

TEL : +81-3-5419-5042 / Fax : +81-3-5419-5901

URL : http://www.orix.co.jp/grp/en/

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is an integrated financial services group based in Tokyo, Japan, providing innovative value-added products and services to both corporate and retail customers. With operations in 27 countries and regions worldwide, ORIX’s activities include corporate financial services, such as leases and loans, as well as automobile operations, rental operations, real estate, life insurance, trust and banking and loan servicing. For more details, please visit our website at: http://www.orix.co.jp/grp/en/

|

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2010 – March 31, 2011.” |

- View PDF of this release

- PDF

[57KB]

[57KB]

- PDF