News Release

ORIX Life Insurance Conducts Survey on Selection of Insurance Products

-Two in three respondents considered no more than two companies when enrolling in a policy-

-85% of consumers showed interest in using comparative information on products offered by various insurance companies-

Oct 31, 2011

TOKYO, Japan – October 31, 2011 – ORIX Life Insurance Corporation, a subsidiary of ORIX Corporation, has conducted a survey on information sought by consumers when considering enrollment in life insurance, and the process leading up to purchases of insurance products. The survey covered men and women aged 25 to 59 living in the Tokyo metropolitan area who have enrolled in death benefit life insurance in the past 2 years. The survey was conducted through a group interview and questionnaire.

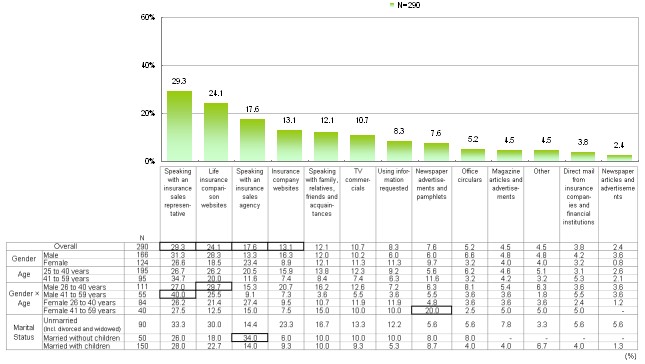

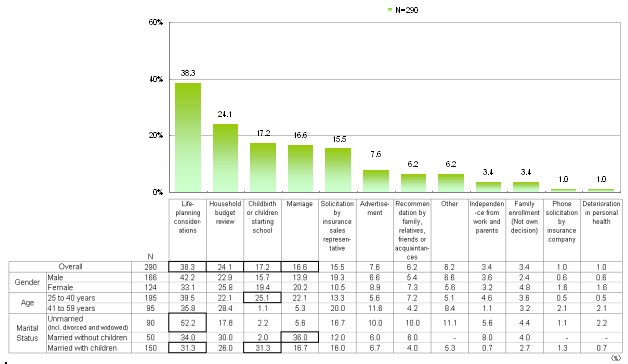

(1) Source of Information for Policy Enrollment: Life Insurance Comparison Websites 24.1%

Respondents cited various reasons for enrolling in death benefit insurance or considering such insurance. The most common reasons were “life-planning considerations,” with a response rate of 38.3%, and “household budget review,” with a response rate of 24.1%. These were followed by reasons related to major turning points in the lives of respondents, such as “childbirth or children starting school” and “marriage,” with response rates of 17.2% and 16.6%, respectively. <Attachment (2)>

At the next stage of considering actual death benefit policy products, “speaking with an insurance sales representative,” was the most popular way of finding out about insurance products, placing first with a 29.3% response rate. However, the survey also found that a large 24.1% share of respondents used “life insurance comparison websites,” meaning that nearly one in four respondents turned to the Internet as a source of information. <Attachment (3)>

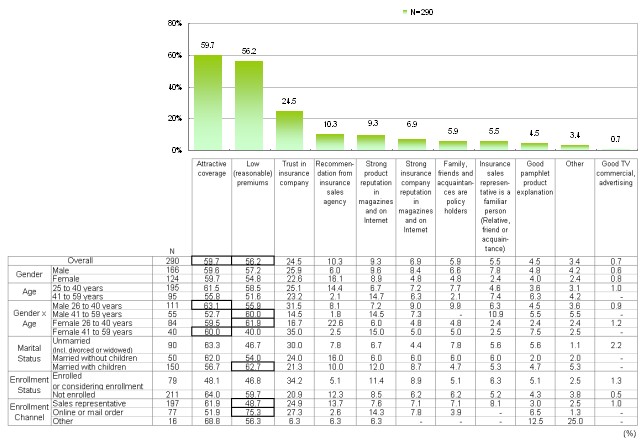

(2) The Deciding Factor for Policy Enrollment: Attractive Coverage 59.7%, Low (Reasonable) Premiums 56.2%

“Attractive coverage” and “low (reasonable) premiums” were cited as key factors for enrollment in insurance policies by 59.7% and 56.2% of respondents, respectively. Looking at trends by gender and age group, male respondents aged 40 or younger tended to emphasize “attractive coverage,” whereas male respondents aged 41 or older tended to emphasize “low (reasonable) premiums.” In contrast, there was a tendency for female respondents aged 40 or younger to emphasize “low (reasonable) premiums,” whereas female respondents aged 41 or older tended to emphasize “attractive coverage.” By enrollment channel, 75.3% of respondents who enrolled through the direct sales channel emphasized “low (reasonable) premiums.” This far outstripped the 48.7% of respondents who enrolled through face-to-face sales channels who also emphasized “low (reasonable) premiums.” Married respondents with children tended to put stronger emphasis on “low (reasonable) premiums” than singles or those married without children. <Attachment (4)>

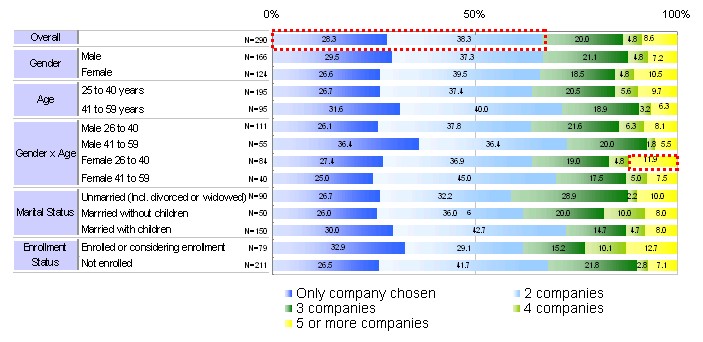

(3) No. of Insurance Companies Considered or Compared: “Two Companies or Less” 66.6%

Looking at the number of insurance companies considered or compared when enrolling, respondents who considered only 1 insurance company accounted for 28.3% of the whole, while those who compared 2 companies accounted for 38.3%. This means that every 2 in 3 respondents (66.6%) considered no more than 2 companies. Respondents aged 41 or older considered or compared fewer companies than those aged 40 or younger, with this trend particularly apparent in men. On the other hand, many of the respondents who compared three or more companies were women. Of the female respondents aged 40 or younger, 11.9% compared 5 or more companies. By family composition, married respondents with children compared fewer companies than singles and those married without children. <Attachment (5)>

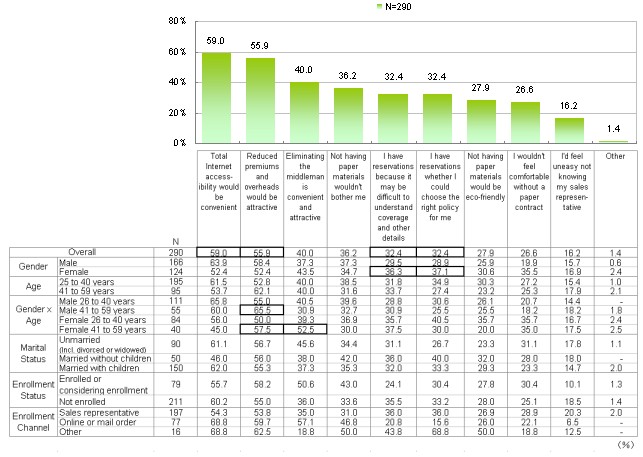

(4) Internet Applications: “Total Internet Accessibility Would Be Convenient” 59.0%, “Reduced Premiums and Overheads Would Be Attractive” 55.9%

In regard to evaluations of Internet applications, 59.0% of respondents noted that “Total Internet accessibility would be convenient,” while 55.9% noted that the “Reduced premiums and overheads would be attractive.” Notably, respondents who enrolled in insurance through the direct sales channel gave a higher overall evaluation than those who enrolled through the face-to-face sales channel. On the other hand, many female respondents expressed reservations about whether they could understand detailed rules and other terms, or select an insurance product meeting their needs. <Attachment (6)>

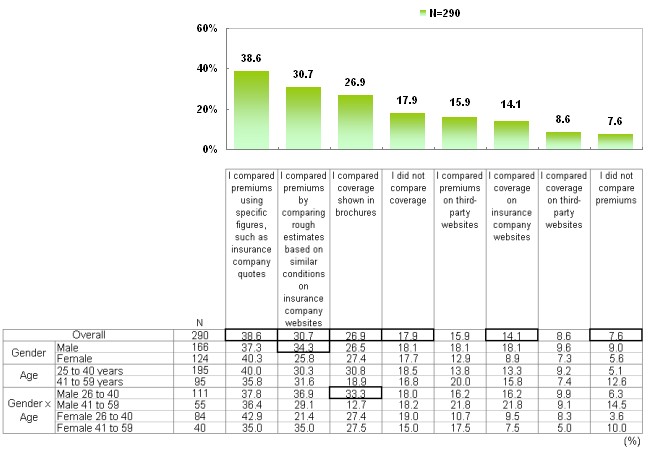

(5) Comparison of Premiums: “Compare Insurance Premiums” 38.6%, “Compare Information on Websites” 30.7%

When enrolling in insurance, respondents who compared the coverage details of insurance companies they were interested in using brochures accounted for 26.9% of the whole, whereas respondents who compared information on the websites of insurance companies accounted for 14.1%. When comparing premiums, 38.6% of respondents compared insurance premiums, whereas 30.7% compared information on websites. In addition, 17.9% of respondents did not compare coverage, whereas only 7.6% of respondents did not compare premiums. <Attachment (7)>

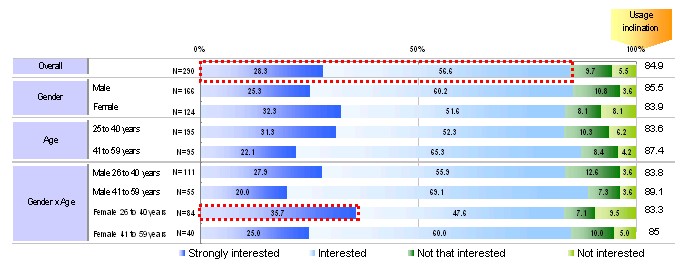

(6) Degree of Interest in Using Comparative Information: Affirmative Response Rate of 84.9% Combining “Strongly Interested” and “Interested” Respondents

As a sample for this survey, ORIX Life Insurance prepared a list comparing the coverage, premiums and other details of each product offered by various insurance companies, and asked survey respondents whether they would be interested in using such information. In response, 28.3% of respondents were “strongly interested” in using the information, whereas 56.6% of respondents were “interested” in using such information. Overall, a total of 84.9% of respondents wish to use such information. Notably, female respondents aged 40 or younger who expressed strong interest in using comparative information accounted for 35.7% of this group, exceeding the overall average by 7 percentage points. <Attachment (8)>

Conclusions

This survey shows that customers are seeking insurance products that offer attractive coverage at low premiums that do not weigh down household budgets. However, when actually considering enrollment in a policy, most customers consider or compare only a few insurance companies. The survey also found that most customers want a list of comparative information on products offered by various insurance companies to facilitate consideration and comparison of the insurance products of different insurance companies. At the same time, although customers have access to a variety of information through the Internet and other means, and can easily complete application procedures online, the survey revealed that many customers are cautious about applying online.

In light of these survey findings, ORIX Life Insurance will continue to enhance the quality of information it provides to customers so that they can choose insurance products that fit their needs.

Attachment (1)

○ Survey Outline

□ Group Interview

1. Purpose of Survey

To understand what information is needed by consumers to choose an insurance product that fits their needs by clarifying consumer thinking and the process leading up to the purchase of an insurance product, as well as the specific points of consideration.

2. Scope of Survey

Consumers who have either enrolled in death benefit insurance (within the past year) or are considering enrolling in such insurance, living in the Tokyo metropolitan area (the Tokyo metropolis and three prefectures of Chiba, Saitama and Kanagawa.)

A total of 11 men and women aged 25 to 59.

3. Method of Survey

Discussion

4. Date of Survey

July 2, 2011 (Saturday)

5. Survey Contractor

SURVEY RESEARCH CENTER CO. LTD.

□ Internet Survey

1. Purpose of Survey

To verify the survey hypothesis based on the findings of the group interview and explore this hypothesis through a quantitative survey.

2. Scope of Survey

Consumers who have either enrolled in death benefit insurance (within the past two years) or are considering enrolling in such insurance, living in the Tokyo metropolitan area (the Tokyo metropolis and three prefectures of Chiba, Saitama and Kanagawa.)

A total of 290 men and women aged 25 to 59.

3. Period of Survey

July 15 (Friday) to July 19 (Tuesday), 2011

4. Survey Contractor

SURVEY RESEARCH CENTER CO. LTD.

Attachment (2)

○ Internet Survey Findings (Excerpts)

(Question) Why did you enroll in death benefit insurance?

(Answer)

Overall, the most common answer was “life-planning considerations,” placing first with a high 38.3% response rate, next to “household budget review,” with a 24.1% response rate. These were followed by reasons related to major turning points in the lives of respondents, such as “childbirth or children starting school” at 17.2%, and “marriage” at 16.6%.

By family status of respondent, “life-planning considerations” generally had the highest response rates, at 52.2% among singles and 31.3% among those married with children, with the exception of those married without children. Meanwhile, “marriage” had the highest response rate among those married without children, at 36.0%.

Moreover, 25.1% of respondents aged 40 or younger and 31.3% of those married with children cited “childbirth or children starting school.”

(Multiple responses, N=number of respondents)

Attachment (3)

(Question) How did you find out about your present death benefit insurance (or insurance policy with a death benefit rider)?

(Answer)

Overall, “speaking with an insurance sales representative” registered a response rate of 29.3%, followed by “life insurance comparison websites” at 24.1%, “speaking with an insurance sales agency” at 17.6%, and “speaking with family, relatives, friends and acquaintances” at 12.1%.

By age group, “speaking with an insurance sales representative” garnered a high response rate among those aged 41 or older, particularly men. Among respondents aged 40 or younger, particularly men, “life insurance comparison websites” showed a high response rate.

High response rates were registered among women aged 41 or older for “newspaper advertisements and pamphlets,” at 20.0%, and among those married without children for “speaking with insurance sales agencies” at 34.0%.

(Multiple responses, N=number of respondents)

Attachment (4)

(Question) What were the key factors behind your decision to enroll in death benefit insurance?

(Answer)

Overall, two answers garnered the highest response rates. “Attractive coverage” and “low (reasonable) premiums” were chosen by 59.7% and 56.2% of respondents, respectively.

By gender and age group, “attractive coverage” registered a 63.1% response rate among male respondents aged 40 or younger, while “low (reasonable) premiums” registered a 60.0% response rate among male respondents aged 41 or older, indicating the different preferences of each of these age groups. In contrast, “low (reasonable) premiums” registered a 61.9% response rate among female respondents aged 40 or younger, while “attractive coverage” registered a 60.0% response rate among female respondents aged 41 or older, indicating the different preferences of each of these age groups.

By enrollment channel, 75.3% of respondents who enrolled through the direct sales channel (online or mail order) put emphasis on “low (reasonable) premiums,” far outstripping the 48.7% of respondents who enrolled through face-to-face sales channels (sales representative channel) who also emphasized “low (reasonable) premiums.” Those married with children tended to put stronger emphasis on “low (reasonable) premiums” than singles or those married without children.

(Multiple responses, N=number of respondents)

Attachment (5)

(Question) How many companies did you consider (including your chosen company) for death benefit insurance?

(Answer)

Looking at the overall number of companies considered, 28.3% of respondents only considered the company they chose, while 38.3% of respondents compared two companies. Therefore, 2 in every 3 respondents (66.6%) considered no more than 2 companies.

Respondents aged 41 or older considered or compared fewer companies then respondents aged 40 or younger, with this trend particularly apparent in men. On the other hand, many respondents who compared three or more companies were women. Of women aged 40 or younger, a 11.9% compared 5 or more companies. By family composition, those married with children compared fewer companies than singles and those married without children.

(Single response, N=number of respondents)

Attachment (6)

(Question) How would you feel if all policy enrollment channels were to be made accessible over the Internet?

(Answer)

Overall, this question garnered affirmative responses, based on the following two points: “Total Internet accessibility would be convenient,” with a response rate of 59.0%, and “Reduced premiums and overheads would be attractive,” with a response rate of 55.9%. However, many respondents also concurred with the following: “I have reservations because it may be difficult to understand coverage and other details” and “I have reservations whether I could choose the right policy for me.” Each of these responses garnered a 32.4% response rate.

Respondents who enrolled in insurance through a direct sales channel (online or mail order) gave a higher overall evaluation than those who enrolled through face-to-face sales channel (sales representative channel).

Many female respondents concurred with “I have reservations because it may be difficult to understand coverage and other details” and “I have reservations whether I could choose the right policy for me.”

Among respondents aged 41 or older, both men and women gave higher marks to “low premiums” than to “convenience.”

Among female respondents aged 41 or older, 52.5% of respondents gave an affirmative response to the view that “Eliminating the middleman is convenient and attractive.”

(Multiple responses, N=number of respondents)

Attachment (7)

(Question) Did you compare the premiums and coverage details of various insurance companies when enrolling in life insurance?

(Answer)

Overall, the most common response was “I compared premiums using specific figures, such as insurance company quotes,” with a response rate of 38.6%. This was followed by “I compared premiums by comparing rough estimates based similar conditions on insurance company websites,” with a response rate of 30.7%. Moreover, “I compared coverage shown in brochures” had a response rate of 26.9% and “I compared coverage on websites, etc.” had a response rate of 14.1%. Other responses included “I did not compare coverage,” with a response rate of 17.9%, and “I did not compare premiums,” with a response rate of 7.6%.

Male respondents showed a slightly higher response rate than their female counterparts for “I compared information on websites.” There were many respondents aged 40 or younger, particularly men, who indicated, “I received a brochure.”

(Multiple response, N=number of respondents)

Attachment (8)

(Question) If product comparisons for various insurance companies were made available when enrolling in life insurance, would you want to use such information?

(Answer)

Overall, this question received a strongly affirmative response rate of 84.9% (“strongly interested” 28.3% + “interested” 56.6%). Notably, 35.7% of female respondents aged 40 or younger were “strongly interested,” exceeding the overall average by seven percentage points.

(Single response, N=number of respondents)

Contact Information

ORIX Corporation, Investor Relations

TEL : +81-3-5419-5042 / Fax : +81-3-5419-5901

URL : http://www.orix.co.jp/grp/en/

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is an integrated financial services group based in Tokyo, Japan, providing innovative value-added products and services to both corporate and retail customers. With operations in 27 countries and regions worldwide, ORIX’s activities include corporate financial services, such as leases and loans, as well as automobile operations, rental operations, real estate, life insurance, banking and loan servicing. For more details, please visit our website at: http://www.orix.co.jp/grp/en/

|

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2010 – March 31, 2011.” |

- View PDF of this release

- PDF

[496KB]

[496KB]

- PDF