News Release

ORIX Life Insurance Launches Medical Insurance “New CURE” and “New CURE Lady”

―Offering Even More Comprehensive Insurance Protection at Ever More Reasonable Premiums―

Jul 24, 2013

TOKYO, Japan - July 24, 2013 - ORIX Life Insurance Corporation, a subsidiary of ORIX Corporation, announced today that it has renewed its main lifelong medical insurance products "CURE" and "CURE Lady" and will launch "New CURE" and "New CURE Lady"*1 medical insurance on September 2, 2013.

Since its launch in September 2006, "CURE" medical insurance featuring "ample coverage for hospitalization for the seven lifestyle-related diseases," "simple and easily understood products" and "reasonable insurance premiums," has won strong support from its many customers*2. While retaining these existing features, the new insurance products "New CURE" and "New CURE Lady" were developed in the hope of providing customers with even greater peace of mind and offer expanded insurance coverage for long-term hospitalization caused by the seven lifestyle-related diseases at even lower premiums than existing products.

Medical insurance "New CURE" provides coverage for an unlimited number of hospitalization days due to the three major diseases (cancer, heart disease and stroke) (Unlimited Plan for the Three Major Diseases). Customers may also opt for a plan that provides coverage for an unlimited number of hospitalization days due to the seven lifestyle-related diseases (Unlimited Plan for the Seven Major Diseases).

Main Revisions of "New CURE" and "New CURE Lady"

1. Insurance coverage for an unlimited number of days of hospitalization due to the three major diseases or the seven major lifestyle-related diseases. (Depending on choice of plan) [For "New CURE" only]

2. Insurance coverage for surgical procedures has been extended to all procedures covered by the national medical insurance system.

3. The maximum total insurance benefit for advanced medical treatment has been increased from ¥10 million to ¥20 million.

4. Lower premiums have been realized even while providing expanded insurance coverage.

5. A "Premium Waiver Provision for Specified Diseases" exempting policyholders from future premium payments if diagnosed with specific conditions as a result of cancer, acute myocardial infarction or cerebral stroke can be applied.

ORIX Life Insurance will continue to develop insurance products fine-tuned to customer needs, while further enhancing services, with the view to becoming a life insurer that delivers true customer satisfaction.

(*1) With the launch of the foregoing products, ORIX Life Insurance will discontinue sales of medical insurance "CURE" and "CURE Lady" on September 1, 2013.

(*2) The number of insurance policies in force for medical insurance "CURE" and other "CURE" series products surpassed 1 million at the end of February 2013.

(Press release issued on March 21, 2013 http://www.orix.co.jp/ins/koho/news/2012/n130321_3.htm![]() )(Japanese only)

)(Japanese only)

The CURE series includes medical insurance "CURE," medical insurance "CURE Lady," medical insurance "CURE Support," medical insurance "CURE S," and "Relief W" medical insurance with life insurance protection.

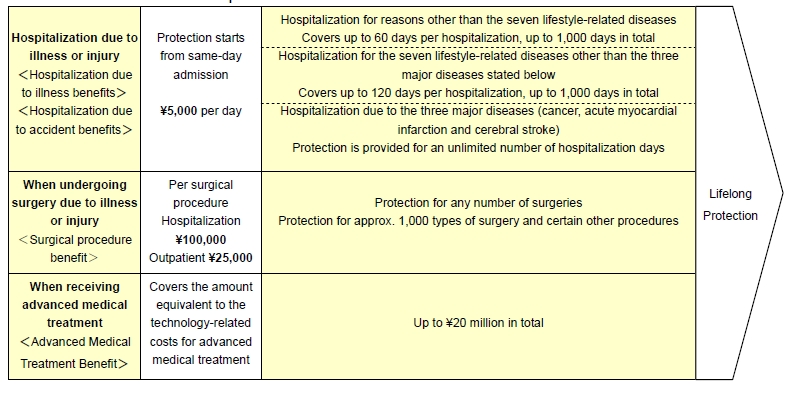

Attachment 1 (Outline of "New CURE")

Non dividend, Non refundable premium type medical insurance (2013)

With hospitalization benefit for the seven lifestyle-related diseases

■Features

1. Lifelong protection is provided for hospitalization due to illness or injury. No refund of premium is provided if the policy is cancelled during the policy payment period, allowing policy premiums to be set lower.

2. Limit on the number of days of hospitalization covered due to the seven lifestyle-related diseases has been extended.

3. Protection for an unlimited number of days of hospitalization due to the three major diseases or the seven major diseases available. (Depending on the choice of plan)

4. Protection for approximately 1,000 types of surgery and certain other procedures covered by the national medical insurance system, regardless of hospitalization.

(In case of hospitalization: A maximum surgical procedure benefit equivalent to twenty times the amount of the daily hospitalization benefit will be paid; In case of outpatient: A maximum surgical procedure benefit equivalent to five times the amount of the daily hospitalization benefit will be paid)

5. Surgical procedure benefit also covers extraction of bone marrow stem cells (provided by bone marrow donors).

6. The minimum radiation intensity of 5,000 rads or more has been removed from the surgical procedure benefit requirement.

7. With the addition of the "Advanced Medical Treatment Option", insurance cover up to a combined maximum of ¥20 million including advanced medical treatment technology-related costs (lifelong insurance).

8. With the addition of the "Cancer Diagnosis Treatment Option" and the "Cancer Outpatient Treatment Option" benefits will be paid for diagnosis/treatment of cancer, and outpatient(hospital)care for cancer treatment, respectively.

9. In the event of severe disability, the policyholder is exempt from future premium payments.

10. A "Premium Waiver Provision for Specified Diseases" exempting policyholders from future premium payments if diagnosed with specific conditions as a result of cancer, acute myocardial infarction or cerebral stroke can be applied.

■Example of Policy Details

Unlimited Plan for the Three Major Diseases

Insurance premium payment period: Whole life; Hospitalization benefit ¥5,000 per day (60 days) with Advanced Medical Treatment Option

■Protection Plans (Provision)

・ Hospitalization benefit for seven lifestyle-related diseases (unlimited number of hospitalization days due to the three major diseases)

・ Hospitalization benefit for the seven lifestyle-related diseases (unlimited number of hospitalization days due to the seven major diseases)

・ Premium waiver provision for specified diseases

■Entry Age

From 6 to 75 years old (differs according to insurance premium payment period)

■Policy period/insurance premium payment period

Policy period: Whole life

Insurance premium payment period: Payment until age 55, 60, 65, 70, or Whole life

■ Options

・ Advanced Medical Treatment Option

・ Cancer Diagnosis Treatment Option

・ Cancer Outpatient Treatment Option

* Sales of the "Three Major Diseases Treatment Lump-sum Option" for the current medical insurance CURE" will be discontinued on September 1, 2013.

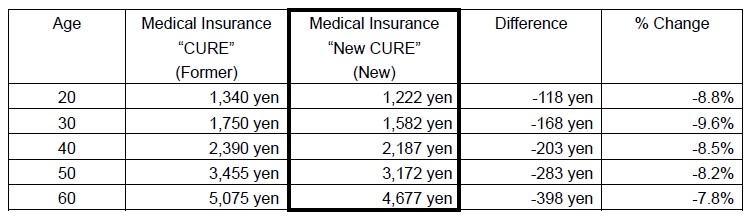

■Example of Premiums

< Comparison of New and Previous Premiums>

Unlimited Plan for the Three Major Diseases

Hospitalization benefit ¥5,000 per day (60 days) with Advanced Medical Treatment Option, No Premium Waiver Provision for Specified Diseases, Monthly payment (automatic debit from bank) and paid over whole life

Example of a male policyholder

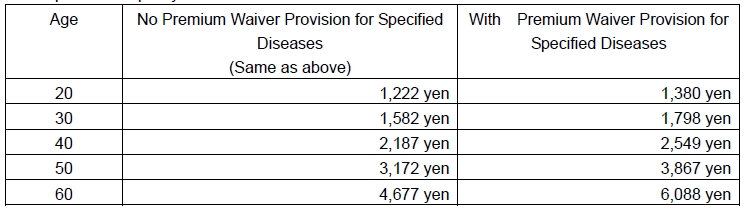

Comparison of Policy with Premium Waiver Provision for Specified Diseases and Policy Without Such Waiver

Unlimited Plan for the Three Major Diseases

Hospitalization benefit ¥5,000 per day (60 days) with Advanced Medical Treatment Option, Monthly payment (automatic debit from bank) and paid over whole life

Example of male policyholder

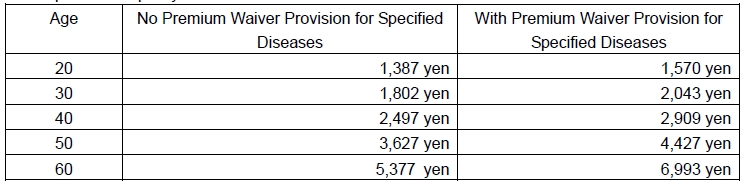

Unlimited Plan for the Seven Major Diseases

Hospitalization benefit ¥5,000 per day (60 days) with Advanced Medical Treatment Option, monthly payment (automatic debit from bank) and paid over whole life

Example of male policyholder

* Certain conditions differ in the case of mail order applications. For example, the Unlimited Plan for the Seven Major Diseases and the Premium Waiver Provision for Specified Diseases are not available when applying by mail order.

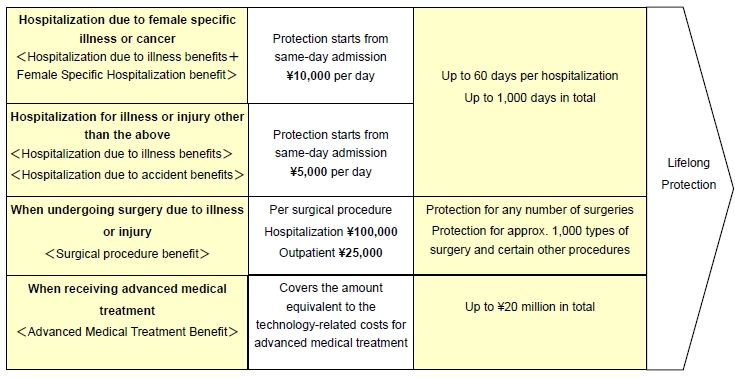

Attachment 2 (Outline of "New CURE Lady")

Non dividend Non refundable premium type medical insurance (2013)

Female Specific Hospitalization Option

■Features

1. Lifelong protection is provided for hospitalization due to illness or injury. No refund of premium is provided if the policy is cancelled during the policy payment period, allowing policy premiums to be set lower.

2. Particularly comprehensive coverage is provided for hospitalization due to female specific illnesses and all cancers.

3. Protection for approximately 1,000 types of surgery and certain other procedures covered by the national medical insurance system, regardless of any hospitalization.

(In case of hospitalization: A maximum surgical procedure benefit equivalent to twenty times the amount of the daily hospitalization benefit will be paid; In case of outpatient: A maximum surgical procedure benefit equivalent to five times the amount of the daily hospitalization benefit will be paid)

4. Surgical procedure benefit also covers extraction of bone marrow stem cells (provided by bone marrow donors).

5. The minimum radiation intensity of 5,000 rads or more has been removed from the surgical procedure benefit requirement.

6. With the addition of the "Advanced Medical Treatment Option Protection", insurance cover up to a combined maximum of ¥20 million including advanced medical treatment technology-related costs (lifelong insurance).

7. With the addition of the "Cancer Diagnosis Treatment Option" and the "Cancer Outpatient Treatment Option" benefits will be paid for diagnosis/treatment of cancer, and outpatient(hospital)care for cancer treatment, respectively.

8. In the event of severe disability, the policyholder is exempt from future premium payments.

9. A "Premium Waiver Provision for Specified Diseases" exempting policyholders from future premium payments if diagnosed with specific conditions as a result of cancer, acute myocardial infarction or cerebral stroke can be applied.

■Example of Policy Details

Primarily policy ¥5,000 per day + Female Specific Hospitalization Option ¥5,000 (60 days), Advanced Medical Treatment Option, Insurance premium payment period: Whole life

■Entry Age

From 16 to 75 years old (differs according to insurance premium payment period)

■Policy period/insurance premium payment period

Policy period: Whole life

Insurance premium payment period: Payment until age: 55, 60, 65, 70, and whole life

■Protection Plan(Provision)

・ Premium Waiver Provision for Specified Diseases

■Options

・ Advanced Medical Treatment Option

・ Cancer Diagnosis Treatment Benefit Option

・ Cancer Outpatient Treatment Option

* Sales of the "Three Major Diseases Treatment Lump-sum Option" for the current medical insurance "CURE Lady" will be discontinued on September 1, 2013.

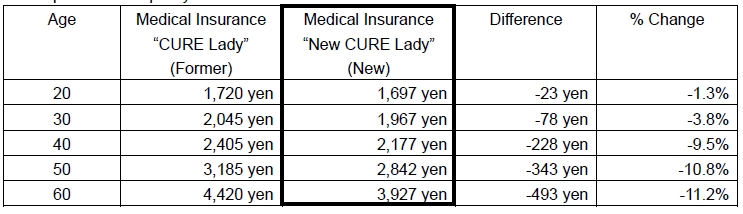

■ Examples of Premiums

Comparison of New and Previous Premiums

Primary policy ¥5,000 per day + Female Specific Hospitalization Option ¥5,000 (60 days), Advanced Medical Treatment Option, Monthly payment (automatic debit from bank), Paid over whole life

Example of female policyholder

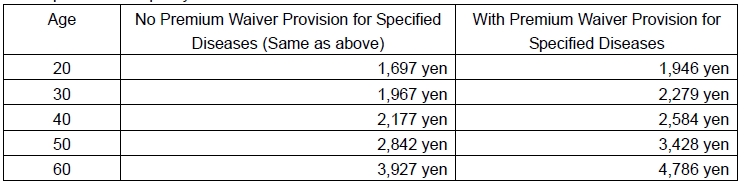

Comparison of Policy with Premium Waiver Provision for Specified Diseases and Policy Without Such Waiver

Primarily policy ¥5,000 per day + Female Specific Hospitalization Option ¥5,000 (60 days), Advanced Medical Treatment Option, Monthly payment (automatic debit from bank), Paid over whole life

Example of female policyholder

* Certain conditions differ in the case of mail order applications. For example, the Premium Waiver Provision for Specified Diseases is not available when applying by mail order.

* From September 2, 2013, the policy details of other products will also be revised. Please see Attachment 3 "Outline of Policy Revisions to Other Products"![]() [269KB] for details.

[269KB] for details.

Contact Information

ORIX Corporation, Corporate Planning Department

TEL : +81-3-3435-3121 / Fax : +81-3-3435-3154

URL : http://www.orix.co.jp/grp/en/

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is an integrated financial services group based in Tokyo, Japan, providing innovative value-added products and services to both corporate and retail customers. With operations in 34 countries and regions outside of Japan, ORIX's activities include corporate financial services, such as leases and loans, as well as automobile operations, rental operations, real estate, life insurance, banking and loan servicing. For more details, please visit our website: http://www.orix.co.jp/grp/en/

|

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2012– March 31, 2013.” |

- View PDF of this release

- PDF

[269KB]

[269KB]

- PDF