News Release

ORIX Expands Factoring Service for Medical Treatment, Nursing Care and Drug Dispensing Reimbursement Fees Receivable

Sep 26, 2011

TOKYO, Japan – September 26, 2011 – ORIX Corporation (TSE: 8591; NYSE: IX), a leading integrated financial services group, announced today that it has expanded its factoring service for medical treatment, nursing care and drug dispensing reimbursement fees receivable.

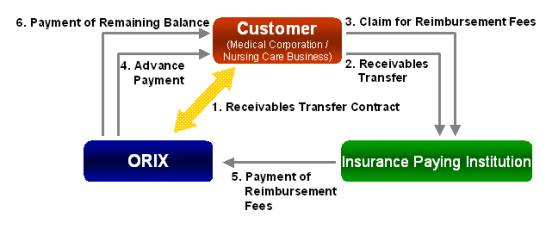

The factoring service for medical treatment, nursing care and drug dispensing reimbursement fees receivable is a service whereby ORIX purchases the receivables held by corporations and sole proprietors operating clinics, nursing care businesses and dispensing pharmacies against insurance-paying institutions, namely National Health Insurance Organizations (National Health Insurance) and Health Insurance Claims Review & Reimbursement Services (Social Security). By having ORIX purchase their receivables at a fixed discount, customers can convert receivables usually paid within approximately two months to cash at an earlier stage. The service thus enables customers to simultaneously improve their cash flows and streamline their balance sheets.

ORIX launched its factoring service for medical treatment, nursing care and drug dispensing reimbursement fees receivable in April 2010. Until now, ORIX has only offered the service to customers with monthly receivables of at least ¥15 million. However, ORIX has now expanded the service by reducing the receivables amount that it will purchase from ¥15 million to ¥3 million per month, while easing the requirement for customers to have been operating for at least three years to one year. ORIX also removed the requirement for customers to provide a joint guarantor. Through these changes, ORIX intends to answer the needs of an even broader range of customers than before.

ORIX has to date provided the medical and nursing care sectors with a variety of services, including loans secured by transfers of medical treatment, nursing care and drug dispensing reimbursement fees receivable, as well as the rental of medical equipment. Going forward, ORIX will continue helping customers to expand their businesses by providing specialized services to clients in a variety of sectors.

| Eligible businesses | Corporations or sole proprietors (However, the business must have been in business for at least one year) |

|---|---|

| Eligible receivables | Medical treatment, nursing care and drug dispensing reimbursement fees receivable |

| Contract period | One year (automatically renewed after one year) |

| Discount rate | 1.0% |

| Administration fee | 31,500 yen (only at initial contract signing) |

| Execution date | :20th day of every month |

| Joint guarantor *Payment method |

Not necessary |

| for purchased receivables | The payment is made in two installments. The first installment is paid on the 20th day of the month in which claims are filed with the insurance-paying institution.The first payment is 85% of the receivables, less the above discount rate and administration fee. The second installment is paid after ORIX has received payment from the insurance-paying institution. Payment of the remaining balance is made within five business days. |

Contact Information

ORIX Corporation, Investor Relations

TEL : +81-3-5419-5042 / Fax : +81-3-5419-5901

URL : http://www.orix.co.jp/grp/en/

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is an integrated financial services group based in Tokyo, Japan, providing innovative value-added products and services to both corporate and retail customers. With operations in 27 countries and regions worldwide, ORIX’s activities include corporate financial services, such as leases and loans, as well as automobile operations, rental operations, real estate, life insurance, trust and banking and loan servicing. For more details, please visit our website at: http://www.orix.co.jp/grp/en

|

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2010 – March 31, 2011.” |

- View PDF of this release

- PDF

[28KB]

[28KB]

- PDF