News Release

ORIX Life Insurance Launches Whole Life Insurance “RISE Support”

and Rider for Medical Insurance “CURE Support”

-Supporting People with Pre-Existing Medical Conditions

or a Prior Record of Hospitalization or Surgery-

Sep 05, 2011

TOKYO, Japan - September 5, 2011 - ORIX Life Insurance Corporation, a subsidiary of ORIX Corporation, announced today that it will launch whole life insurance RISE Support, a nonparticipating whole life insurance policy with relaxed underwriting conditions and low cash surrender value (hereinafter “RISE Support”) on October 2, 2011. ORIX Life Insurance will also begin offering a whole life insurance rider with relaxed underwriting conditions and low cash surrender value (hereinafter “whole life insurance rider with relaxed conditions”) on the same day.

RISE Support facilitates the enrollment of customers with pre-existing medical conditions or a prior record of hospitalization or surgery by limiting declarations and easing the underwriting conditions. The whole life insurance rider with relaxed conditions is a rider for the highly popular medical insurance CURE Support that was launched in October 2010. The rider allows CURE Support policyholders to attach lifelong death benefit protection to their medical insurance. Enrollment in both products is available to customers between the ages of 20 to 80, and broad underwriting conditions have been established. These products are available through face-to-face sales channels as well as direct sales channels, including online application. A product overview follows below.

Customers currently enrolled in medical insurance CURE Support will have the option to attach the whole life insurance rider with relaxed conditions to their policies beginning January 2012.

ORIX Life Insurance’s online insurance application service began service in May 2011. The company is working to further enhance customer convenience through this service where customers can easily apply for insurance over the Internet in their spare time, enabling insurance protection to take effect on the same day. Following policy enrollment, customers can confirm policy details, notify a change of address and perform other procedures from their personal online accounts.

Based on the product development concept of “simple and easily understood products” and “reasonable insurance premiums,” ORIX Life Insurance will continue to develop insurance products fine-tuned to customer needs, while further enhancing services.

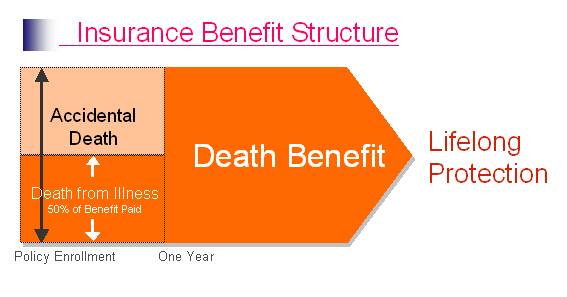

How Whole Life Insurance RISE Support Works

Whole life insurance RISE Support provides lifelong protection. In the event of the death of the insured, the policy will pay a death benefit. (If the insured dies within one year of the date of enrollment, 50% of the benefit will be paid. However, if the insured dies as a result of an unforeseen accident or infectious disease, the insurance benefit will be paid in full.)

Certain restrictions apply to the cash surrender value of the policy during the period of insurance premium payments.

Features

1. This whole life insurance policy facilitates enrollment by people with pre-existing medical conditions or a prior record of hospitalization or surgery.

2. Death benefit protection lasts for the entire lifetime of the insured.

3. Customers may select the amount of insurance benefit based on their needs.

4. If a policyholder is given six months or less to live, insurance benefits will be paid even while the insured is alive, provided that the “living need” rider is attached.

5. Insurance protection is provided even in the event that the worsening of a pre-existing medical condition leads to death.

Contact Information

ORIX Corporation, Investor Relations

TEL : +81-3-5419-5042 / Fax : +81-3-5419-5901

URL : http://www.orix.co.jp/grp/en/

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is an integrated financial services group based in Tokyo, Japan, providing innovative value-added products and services to both corporate and retail customers. With operations in 27 countries and regions worldwide, ORIX’s activities include corporate financial services, such as leases and loans, as well as automobile operations, rental operations, real estate, life insurance, trust and banking and loan servicing. For more details, please visit our website at: http://www.orix.co.jp/grp/en/

|

These documents may contain forward-looking statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2010 – March 31, 2011.” |

- View PDF of this release

- PDF

[37KB]

[37KB]

- PDF